2nd Jul 2021. 7.15am

Regency View:

Morning Report – Friday 2nd July

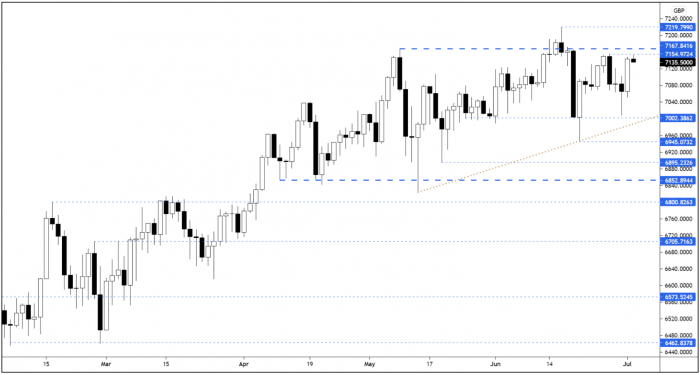

FTSE to open at 7,134 (+9 pts)

The S&P posted its sixth consecutive session of record highs yesterday – indicating that expectations are looking lofty as we head into today’s non-farm payrolls number.

Economists polled by Bloomberg forecast that the US economy added 700,000 jobs in June – driven by the leisure and hospitality industries.

Overnight in Asia, Chinese-related stocks continued their recent under-performance with Hong Kong’s Hang Seng index dropping amid speculation the Chinese central bank could begin tightening monetary policy.

| S&P 500 | +0.52% | Bullish for UK stocks |

| Hang Seng | -1.82% | Bearish for UK stocks |

| Gold | +0.11% | Neutral for UK stocks |

| AUD/JPY | +0.07% | Neutral for UK stocks |

| US 10yr Yield | -0.86% | Neutral for UK stocks |

We highlighted in yesterday’s morning report that the long-tailed bullish candle which formed on Wednesday could lay the foundation for a strong session and that’s exactly what we saw…

The FTSE showed clear strength and closed near intra-day highs – taking the market up into the resistance zone once again.

| Interim Results |

| Reach Plc (RCH) |

| International Economic Announcements |

| (07:00) Retail Sales (GER) |

| (10:00) Producer Price Index (GER) |

| (13:30) Non-Farm Payrolls (US) |

| (13:30) Unemployment Rate (US) |

| (15:00) Factory Orders (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.