29th Apr 2022. 7.44am

Regency View:

Morning Report – Friday 29th April

FTSE to open at 7,572 (+63 pts)

The currency markets dominated the headlines yesterday with the US dollar hitting 20-year highs as traders ramped up bets that aggressive rate hikes from the Fed will leave other major central banks trailing far in its wake.

While the Japanese yen sank to a 20-year low after the Bank of Japan vowed to buy unlimited amounts of 10-year bonds daily to defend its yield target.

US stocks gained ground for a second session on the back of strong quarterly from the likes of Facebook parent Meta Platforms. And overnight in Asia, the Hang Seng has jumped more than 3% with Chinese tech stocks, Tencent and Alibaba leading the way.

| S&P 500 | +2.47% | Bullish for UK stocks |

| Hang Seng | +3.22% | Bullish for UK stocks |

| Gold | +0.94% | Bearish for UK stocks |

| AUD/JPY | +0.42% | Bullish for UK stocks |

| US 10yr Yield | -10pts | Neutral for UK stocks |

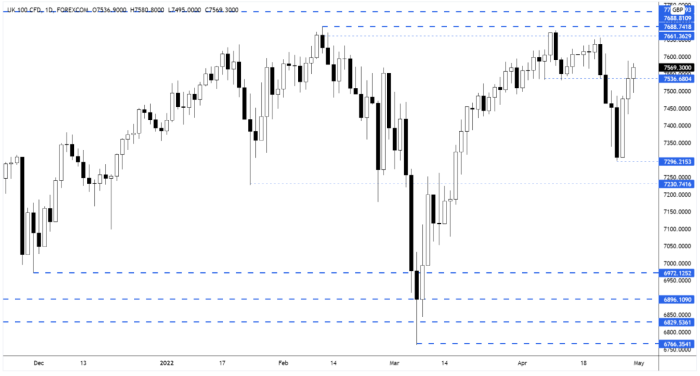

As highlighted in yesterday’s Morning Report, Wednesday’s bullish two-bar reversal pattern set the stage for a retest of the broken support area at 7,536 is exactly what we saw.

The market now needs to hold above the broken support level to indicate that it will not become a new area of resistance.

| Interim Results |

| Natwest Grp (NWG) |

| Astrazeneca (AZN) |

| Trading Announcements |

| Travis Perkins (TPK) |

| Smurfit Kappa (SKG) |

| Rotork (ROR) |

| International Economic Announcements |

| 08:00 Gross Domestic Product (QoQ)(Q1) PREL (GER) |

| 08:00 SNB’s Chairman Jordan speech (CHF) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.