28th Jan 2022. 7.39am

Regency View:

Morning Report – Friday 28th January

FTSE to open at 7,545 (-9 pts)

The US dollar surged to 18-month highs yesterday as currency traders reacted to Fed chair Jay Powell’s refusal to rule out an aggressive series of interest rate rises this year.

Dollar strength weighed heavy on Wall Street’s stocks with the S&P 500 chopping sideways just above long-term support.

While Apple shares gained more than 2% in post-market trading after the iPhone maker beat profit estimates.

| S&P 500 | -0.54% | Bearish for UK stocks |

| Hang Seng | -1.09% | Bearish for UK stocks |

| Gold | -0.03% | Neutral for UK stocks |

| AUD/JPY | +0.05% | Neutral for UK stocks |

| US 10yr Yield | -3.22% | Bullish for UK stocks |

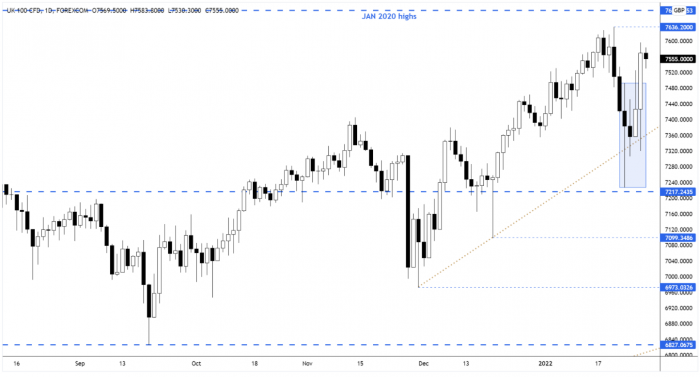

Yesterday’s price action saw the FTSE rally from the ascending trendline and break above the inside day pattern (Monday’s high).

The market is now on course for a ‘bullish reversal week’ and has the January swing highs in its sights.

| Interim Results |

| Hargreaves Lansdown (HL.) |

| Q3 Results |

| Larsen And Toubro (LTOD) |

| Trading Announcements |

| Indust Reit (MLI) |

| International Economic Announcements |

| 13:00 (GER) Gross Domestic Product |

| 17:30 (USD) Michigan Consumer Sentiment Index(Jan) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.