23rd Jul 2021. 7.26am

Regency View:

Morning Report – Friday 23rd July

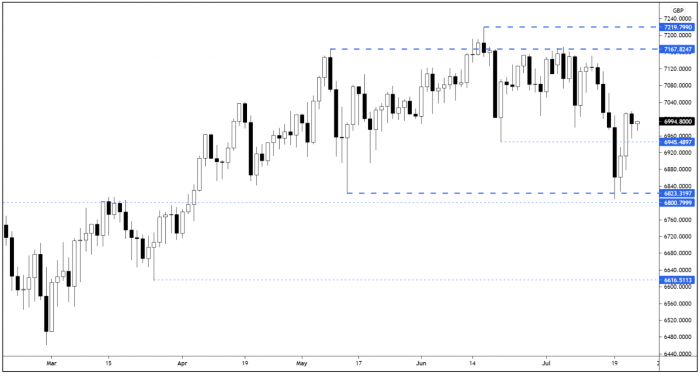

FTSE to open at 6,995 (+27pts)

‘Lower for longer’ was the message from ECB President Christine Lagarde during yesterday’s monetary policy statement…

The ECB also said it would maintain its bond buying program at current levels “until at least the end of March 2022” and “until it judges that the coronavirus crisis phase is over”.

European stocks had rallied earlier in the week to price-in the ECB’s supportive stance, hence there was minimal volatility following the statement.

This morning’s UK retail sales numbers for June showed at 0.5% month-on-month increase and a 9.7% year-on-year increase – just ahead of analysts expectations.

| S&P 500 | +0.20% | Neutral for UK stocks |

| Hang Seng | -1.51% | Bearish for UK stocks |

| Gold | -0.08% | Neutral for UK stocks |

| AUD/JPY | +0.10% | Neutral for UK stocks |

| US 10yr Yield | -0.77% | Neutral for UK stocks |

It’s been a V-shaped reversal week for the FTSE, and if the index can end today’s session above 6,960 the weekly candle chart will form a bullish pin-bar candle.

| Interim Results |

| Beazley (BEZ) |

| Trading Announcements |

| Brewin Dolphin (BRW) |

| Record (REC) |

| UK Economic Announcements |

| (00:01) GFK Consumer Confidence |

| (07:00) Retail Sales |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.