21st Jan 2022. 7.39am

Regency View:

Morning Report – Friday 21st January

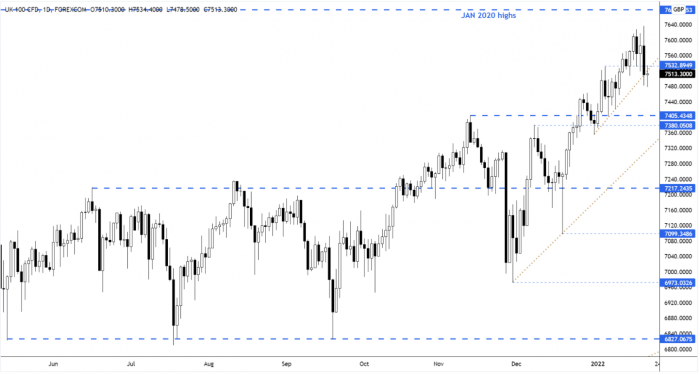

FTSE to open at 7,513 (-72 pts)

Stocks on Wall Street broke to three-month lows yesterday as weaker-than-expected economic and earnings data weighed on sentiment ahead of a Fed policy meeting next week…

Streaming giant, Netflix Inc foretasted weak first-quarter subscriber growth after the New York closing bell. And Asian markets have had a lackluster session with the Hang Seng and Nikkei in negative territory.

This morning’s UK retail sales data came in below analyst expectations – showing a month-on-month drop of -3.6% in December, and a -0.9% drop year-on-year.

| S&P 500 | -1.10% | Bearish for UK stocks |

| Hang Seng | -0.24% | Bearish for UK stocks |

| Gold | +0.09% | Neutral for UK stocks |

| AUD/JPY | -0.59% | Bearish for UK stocks |

| US 10yr Yield | -57pts | Bullish for UK stocks |

Yesterday’s price action saw the FTSE reject higher prices and break decisively lower – closing just below the short-term ascending trendline.

Yesterday’s range eclipsed that of the previous three sessions – forming a bearish engulfing pattern. We would now expect to see the market retest key support at 7,405.

| UK Economic Announcements |

| 07:00 Retail Sales |

| International Economic Announcements |

| 12:30 ECB’s President Lagarde speech |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.