20th May 2022. 7.44am

Regency View:

Morning Report – Friday 20th May

FTSE to open at 7,368 (+65 pts)

Stocks on Wall Street continued to slide yesterday, but did close off of their intra-day lows as buyers stepped in on a retest of last week’s lows.

Overnight in Asia, the Hang Seng has rallied after China cut its five-year loan prime rate (LPR) by 15 basis points in an attempt to boost its housing market.

This morning’s UK retail sales showed less of a contraction than the market had expected, dropping -4.9% in April year-on-year compared to -7.2% expected.

However, UK consumer confidence index fell 2 percentage points to minus 40 in May, its lowest since records began in 1974.

| S&P 500 | -0.58% | Bearish for UK stocks |

| Hang Seng | +2.60% | Bullish for UK stocks |

| Gold | +0.30% | Bearish for UK stocks |

| AUD/JPY | -0.03% | Neutral for UK stocks |

| US 10yr Yield | -45pts | Bullish for UK stocks |

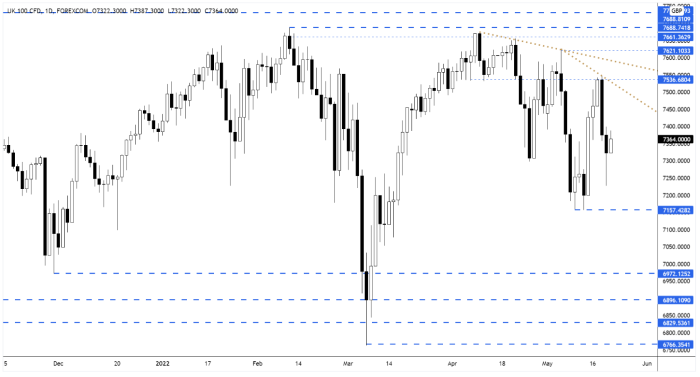

Yesterday’s price action saw the FTSE come close to re-testing the May swing lows at 7,157 before mounting a relief rally which saw the market close some distance from its intra-day lows.

This long-tailed candle is a small bullish sign which may mark a short-term inflection point.

| Final Results |

| Investec (INVP) |

| National Grid (NG.) |

| Qinetiq (QQ.) |

| Royal Mail (RMG) |

| Q1 Results |

| Ab Ignitis. S (IGN) |

| UK Economic Announcements |

| (06:00) Retail Sales (Apr) |

| International Economic Announcements |

| (14:00) Consumer Confidence(May) PREL (EU) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.