1st Oct 2021. 7.37am

Regency View:

Morning Report – Friday 1st October

FTSE to open at 7,007 (-79 pts)

Stocks on both sides of the Atlantic failed to hold onto their gains yesterday as fears of ‘stagflation’ continue to grow.

And the US dollar hit one-year highs as traders anticipate US interest rate rises. Despite the dollar strength, gold rallied 1.8% yesterday – signalling that risk aversion is increasing.

Looking ahead to today’s session, we have manufacturing PMI data from the UK, Germany, EU and US.

| S&P 500 | -1.19% | Bearish for UK stocks |

| Hang Seng | -0.36% | Bearish for UK stocks |

| Gold | -0.16% | Neutral for UK stocks |

| AUD/JPY | -0.45% | Bearish for UK stocks |

| US 10yr Yield | -1.57% | Bullish for UK stocks |

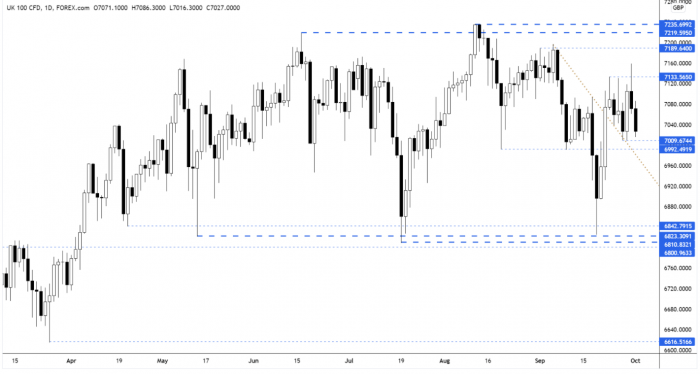

Yesterday’s price action saw the FTSE fail to hold above last week’s highs – closing near intra-day lows and forming a bearish pin-bar candle in the process.

The FTSE futures have moved lower overnight and the cash market is set to open back at short-term support.

| UK Economic Announcements |

| (09:30) PMI Manufacturing |

| International Economic Announcements |

| (07:00) Retail Sales (GER) |

| (08:55) PMI Manufacturing (GER) |

| (09:00) PMI Manufacturing (EU) |

| (13:30) Personal Consumption Expenditures (US) |

| (13:30) Unemployment Rate (US) |

| (13:30) Personal Income (US) |

| (13:30) Personal Spending (US) |

| (14:45) PMI Manufacturing (US) |

| (15:00) ISM Manufacturing (US) |

| (15:00) Construction Spending (US) |

| (20:30) Auto Sales (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.