1st Jul 2022. 7.28am

Regency View:

Morning Report – Friday 1st July

FTSE to open at 7,133 (-36 pts)

With Q2 coming to a close yesterday, stocks on Wall Street confirmed their worst first half in more than 50 years…

The S&P 500 fell 0.88% yesterday, leaving the blue-chip index down by 20.6% in the first six months of 2022. Wall Street has not endured such a weak start to a year since 1970.

In commodities, crude oil is set for its third consecutive weekly loss as fears of a recession demand weighed on sentiment. And stocks in Asia have weakened overnight along with the ‘risk on’ Australian dollar.

| S&P 500 | -0.88% | Bearish for UK stocks |

| Hang Seng | -0.62% | Bearish for UK stocks |

| Gold | -0.48% | Bullish for UK stocks |

| AUD/JPY | -1.58% | Bearish for UK stocks |

| US 10yr Yield | -75pts | Bullish for UK stocks |

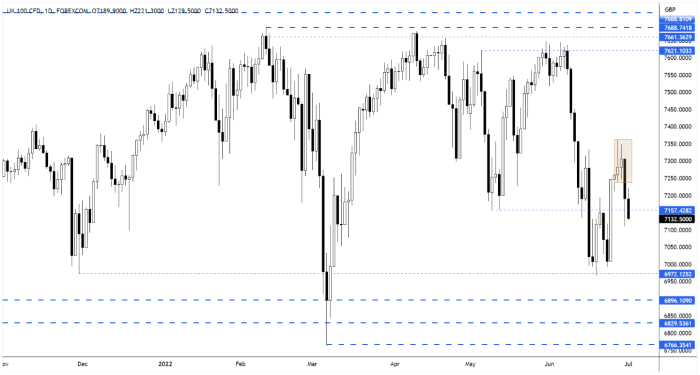

Yesterday’s break lower from Wednesday’s inside day pattern confirms a new inflection point at Tuesday’s high.

The market responded once again to the 7,157 area which has been used as both support and resistance in recent weeks.

However, short-term momentum is starting to turn bearish after last week’s gains.

| Q3 Results |

| Oxford Technology Venture Capital Trust (OXT) |

| UK Economic Announcements |

| (08:30) UK S&P Global / CIPS Manufacturing PMI (Jun) |

| International Economic Announcements |

| (13:45) US S&P Global Manufacturing PMI (Jun) |

| (14:00) ISM Manufacturing PMI (Jun) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.