19th Mar 2021. 7.14am

Regency View:

Morning Report – Friday 19th March

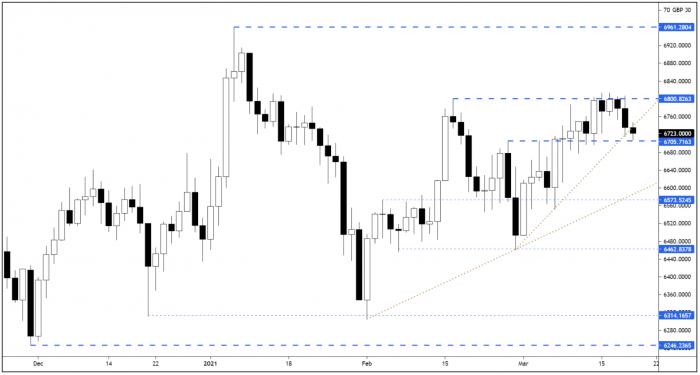

FTSE to open at 6,731 (-48 pts)

We mentioned in yesterday’s Morning Report that the jump in US 10yr yields, which came in spite of the dovish Fed comments, might weigh on stocks and that was certainly the case during the US session…

The S&P 500 put in a sharp reversal – closing back below the February highs, and this negativity followed through into the Asian session with the Hang Seng trading back near its March lows.

Should the S&P close the week near yesterday’s low or lower, this week will represent a short-term inflection point for stocks.

| S&P 500 | -1.48% | Bearish for UK stocks |

| Hang Seng | -2.02% | Bearish for UK stocks |

| Gold | +0.26% | Neutral for UK stocks |

| AUD/JPY | -0.04% | Neutral for UK stocks |

| US 10yr Yield | -1.65% | Bullish for UK stocks |

FTSE futures sank lower during US trading hours and this has set the cash market up for a bearish open.

All eyes are now on 6,705 support – a level which coincides with an ascending trendline. Should the market break this support level, a drop down into 6,600 looks the most likely scenario.

| Final Results |

| ContourGlobal (GLO) |

| Johnson Service (JSG) |

| Sanne Group (SNN) |

| Annual Report |

| James Fisher and Sons (FSJ) |

| Intertek Group (ITRK) |

| UK Economic Announcements |

| (00:01) GFK Consumer Confidence |

| (09:30) Public Sector Net Borrowing |

| International Economic Announcements |

| (07:00) Producer Price Index (GER) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.