19th Feb 2021. 7.45am

Regency View:

Morning Report – Friday 19th February

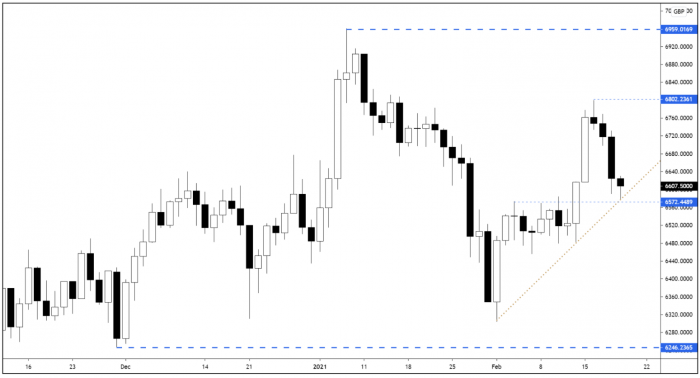

FTSE to open at 6,607 (-10 pts)

European equities are set for a mildly bearish open.

Asian indices continued to retreat from highs, but it should be noted that they have erased much of their losses as we head towards the London open.

For those of you trading gold, the metal hit long-term support $1764 overnight, printing a seven month low.

| S&P 500 | -0.44% | Bearish for UK stocks |

| Hang Seng | -0.09% | Neutral for UK stocks |

| Gold | -0.23% | Neutral for UK stocks |

| AUD/JPY | +0.33% | Bullish for UK stocks |

| US 10yr Yield | +0.91% | Bullish for UK stocks |

The FTSE erased its gains for the week yesterday and that is far from a bullish sign.

However, the market is now back at a confluent area of support which is represented by a retest of top of the broken mini-range and the ascending trendline.

This area needs to hold for the early-Feb recovery story to continue.

| Final Results |

| Natwest Grp (NWG) |

| Segro (SGRO) |

| TBC Bank Group (TBCG) |

| Q4 Results |

| Natwest Grp (NWG) |

| TBC Bank Group (TBCG) |

| UK Economic Announcements |

| (00:01) GFK Consumer Confidence |

| (07:00) Retail Sales |

| International Economic Announcements |

| (07:00) Producer Price Index (GER) |

| (09:00) Existing Home Sales (US) |

| (09:00) Current Account (EU) |

| (10:00) Consumer Price Index (EU) |

| (13:30) Building Permits (US) |

| (15:00) Existing Home Sales (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.