18th Mar 2022. 7.43am

Regency View:

Morning Report – Friday 18th March

FTSE to open at 7,397 (-12 pts)

The BoE’s monetary policy committee voted eight to one to raise interest rates by 0.25 percentage points to 0.75% yesterday. The Central Bank also and predicted that inflation would top 8% by the end of June.

Wall Street’s broad-based S&P 500 index had its best close in roughly a month, ending the day 1.2% higher, after gaining more than 2% on Wednesday.

While oil prices rose more than 8%, continuing a series of wild daily swings, as the market rebounded from several days of losses. And overnight in Asia, Chinese stocks have had a small retracement following two days of strong gains.

| S&P 500 | +1.23% | Bullish for UK stocks |

| Hang Seng | -0.47% | Bearish for UK stocks |

| Gold | -0.38% | Bullish for UK stocks |

| AUD/JPY | +0.48% | Bullish for UK stocks |

| US 10yr Yield | -15pts | Neutral for UK stocks |

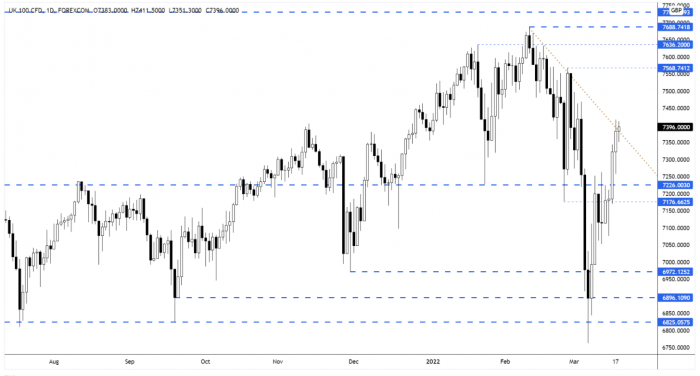

As mentioned in yesterday’s Morning Report that the FTSE could be on for a retest of the descending trendline and that’s exactly what we got…

The cash market is now set to open just above the descending trendline, and we could see some profit taking into the weekend.

| Final Results |

| ContourGlobal (GLO) |

| Eurocell (ECEL) |

| S4 Cap. (SFOR) |

| Zhejiang Exp’h’ (ZHEH) |

| Interim Results |

| Wetherspoon (J.D) (JDW) |

| Trading Announcements |

| Investec (INVP) |

| International Economic Announcements |

| (15:00) Existing Home Sales (US) |

| (10:00) Balance of Trade (EU) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.