17th Jun 2022. 7.39am

Regency View:

Morning Report – Friday 17th June

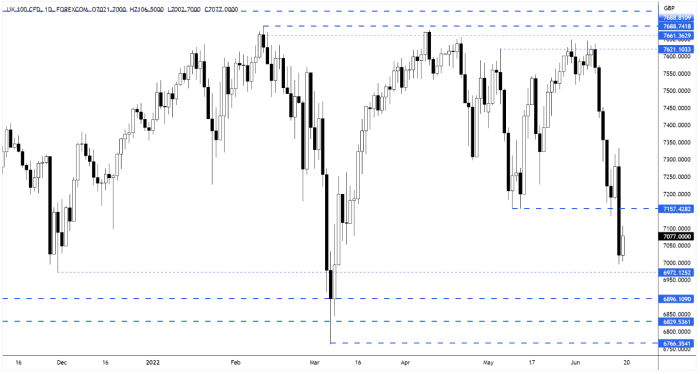

FTSE to open at 7,080 (+35 pts)

The Bank of England and Swiss National Bank followed the Federal Reserve’s lead in raising rates yesterday.

The backdrop of tightening monetary policy and stagnating global growth is taking its toll and stocks on both sides of the Atlantic sank lower yesterday.

Overnight in Asia, stocks are mixed with Hong Kong’s Hang Seng bouncing back (+1.15%) and Japan’s Nikkei 225 breaking lower (-1.77%).

| S&P 500 | -3.25% | Bearish for UK stocks |

| Hang Seng | +1.15% | Bullish for UK stocks |

| Gold | -0.53% | Bullish for UK stocks |

| AUD/JPY | +0.77% | Bullish for UK stocks |

| US 10yr Yield | -95pts | Bullish for UK stocks |

We mentioned in yesterday’s Morning Report that for the bullish ‘support play’ scenario to play out, the market would need to hold in the top quartile of Wednesday’s range. This scenario had collapsed by 9am as the market broke decisively below support.

The market now looks set to retest the March lows reached at the start of the Ukraine war.

| Trading Announcements |

| Tesco (TSCO) |

| UK Economic Announcements |

| (08:30) BoE’s Pill speech |

| (08:30) BoE’s Tenreyro speech |

| International Economic Announcements |

| (12:45) Fed’s Chair Powell speech |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.