15th Jul 2022. 7.41am

Regency View:

Morning Report – Friday 15th July

FTSE to open at 7,067 (+27 pts)

US bank earnings season got off to a weak start yesterday with JPMorgan Chase & Co and Morgan Stanley reporting a slump in profits and warning of an impending economic slowdown.

Analysts now expect aggregate S&P 500 Q2 earnings growth of 5.1%, significantly less than the 6.8% annual growth estimate at the beginning of the quarter, according to Refinitiv.

Overnight in Asia, the Hang Seng dropped more than -2% as China published its second-worst quarterly growth figure in 30 years…

The world’s second-biggest economy expanded 0.4% year on year in Q2, below the 1.2% forecast by economists, and down from the 4.8% recorded in Q1.

| S&P 500 | -0.30% | Bearish for UK stocks |

| Hang Seng | -2.02% | Bearish for UK stocks |

| Gold | -0.31% | Bullish for UK stocks |

| AUD/JPY | -0.41% | Bearish for UK stocks |

| US 10yr Yield | +25pts | Neutral for UK stocks |

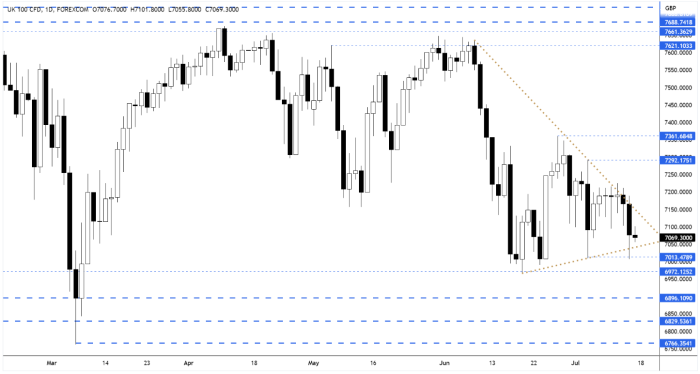

We mentioned in yesterday’s Morning Report that the market was coiling for a directional move and that’s exactly what we got…

The FTSE tumble to the bottom of the choppy wedge consolidation pattern which has been taking shape during the last month.

| Trading Announcements |

| Rio Tinto (RIO) |

| Burberry (BRBY) |

| International Economic Announcements |

| (07:00) Wholesale Price Index (GER) |

| (10:00) Balance of Trade (EU) |

| (13:30) Retail Sales (US) |

| (13:30) Import and Export Price Indices (US) |

| (13:30) Retail Sales Less Autos (US) |

| (14:15) Industrial Production (US) |

| (15:00) Business Inventories (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.