14th May 2021. 7.05am

Regency View:

Morning Report – Friday 14th May

FTSE to open at 6,988 (+25 pts)

US stocks bounced back yesterday, ending a torrid run of three consecutive losing sessions…

The relief rally in the S&P coincided with a weakening in bond yields as Wednesday’s inflationary fears dissipated.

Our risk barometer indicates a bullish backdrop to Friday’s early European trading.

| S&P 500 | +1.22% | Bullish for UK stocks |

| Hang Seng | +0.79% | Bullish for UK stocks |

| Gold | +0.03% | Neutral for UK stocks |

| AUD/JPY | +0.12% | Neutral for UK stocks |

| US 10yr Yield | -2.98% | Bullish for UK stocks |

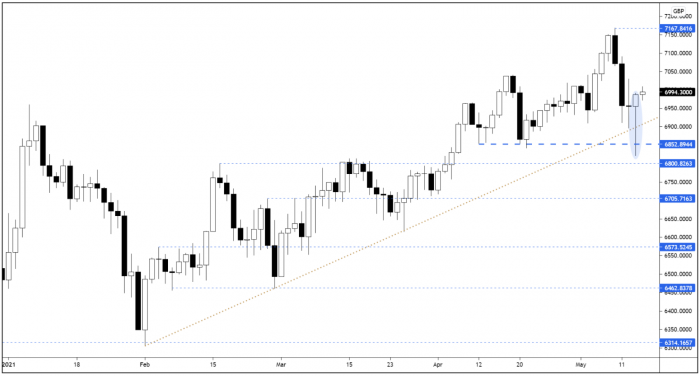

We’ve mentioned several times this week that the April swing lows would be the most significant area of support, and this appears to be the case…

Having touched support earlier in yesterday’s session, the FTSE rallied with gusto to form a bullish hammer candle on the futures chart (below).

| Final Results |

| Gulf Marine Services (GMS) |

| Q1 Results |

| Electrica Regs (ELSA) |

| Romgaz S (SNGR) |

| International Economic Announcements |

| (13:30) Retail Sales (US) |

| (13:30) Import and Export Price Indices (US) |

| (14:15) Industrial Production (US) |

| (14:15) Capacity Utilisation (US) |

| (15:00) U. of Michigan Confidence (Prelim) (US) |

| (15:00) Business Inventories (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.