14th Jan 2022. 7.29am

Regency View:

Morning Report – Friday 14th January

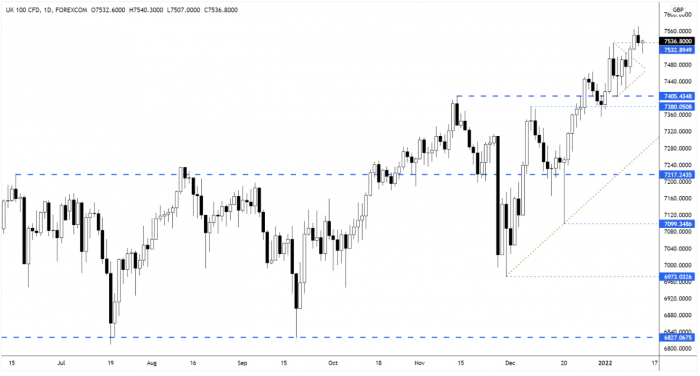

FTSE to open at 7,533 (-31 pts)

After a three-day pause, the US ‘tech wreck’ resumed yesterday with the Nasdaq composite index tumbling 2%.

The sell-off marked a somewhat strange satellite delay from Wednesday’s painfully high US inflation data. And having seemingly been calmed by the Fed’s comments earlier in the week, the inflation panic has kicked back in.

Asian stocks have mirrored the sell-off on Wall Street with Japan’s Nikkei 225 down more than 1%, and the Hang Seng also in negative territory.

| S&P 500 | -1.42% | Bearish for UK stocks |

| Hang Seng | -0.28% | Bearish for UK stocks |

| Gold | +0.18% | Neutral for UK stocks |

| AUD/JPY | -0.38% | Bearish for UK stocks |

| US 10yr Yield | -28pts | Bullish for UK stocks |

The FTSE continues to display strength relative to US stocks so far this year and the UK index only experienced mild selling pressure yesterday.

We are seeing some evidence that last week’s broken swing highs will provide support, but we still can’t rule out a deeper retracement.

| Trading Announcements |

| Bellway (BWY) |

| UK Economic Announcements |

| (07:00) Gross Domestic Product |

| (07:00) Industrial Production |

| International Economic Announcements |

| (13:30) Retail Sales (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.