13th Aug 2021. 7.17am

Regency View:

Morning Report – Friday 13th August

FTSE to open at 7,196 (+3 pts)

The S&P edged out another record close as U.S. initial jobless claims for last week came in at 375,000, down from 387,000 a week earlier and matching economists’ estimates.

While the Vix Volatility Index or ‘Fear Index’ as it’s sometimes referred to, fell more than 3 points on Thursday to 15.5 – significantly below its long-running average of 20. The index had hit highs of +80 during the start of the pandemic in March 2020.

In Asia, stocks continue to dramatically under-perform their U.S. peers, with the Hang Seng down 1.51% on the day and more than 15% below their February highs.

| S&P 500 | +0.30% | Bullish for UK stocks |

| Hang Seng | -1.51% | Bearish for UK stocks |

| Gold | +0.30% | Bearish for UK stocks |

| AUD/JPY | -0.02% | Neutral for UK stocks |

| US 10yr Yield | +1.99% | Bullish for UK stocks |

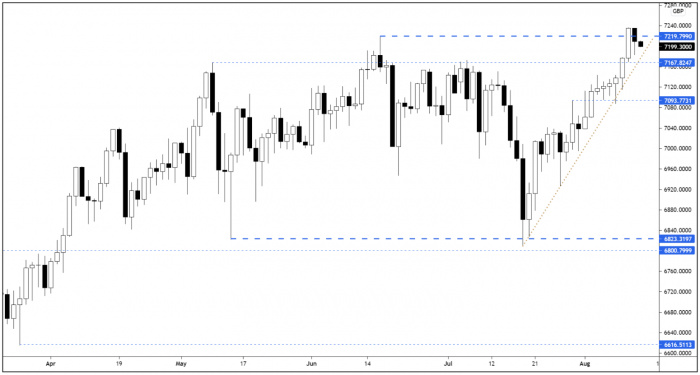

Yesterday’s price action saw the FTSE close back below key resistance, having closed above it on Wednesday.

We’re not in bearish ‘fakeout’ territory just yet, but should the market end the week below yesterday’s low, it would signal a short-term top is in place.

| Interim Results |

| Romgaz S (SNGR) |

| Thungela Res (TGA) |

| International Economic Announcements |

| (10:00) Balance of Trade (EU) |

| (13:30) Import and Export Price Indices (US) |

| (15:00) U. of Michigan Confidence (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.