11th Jun 2021. 7.31am

Regency View:

Morning Report – Friday 11th June

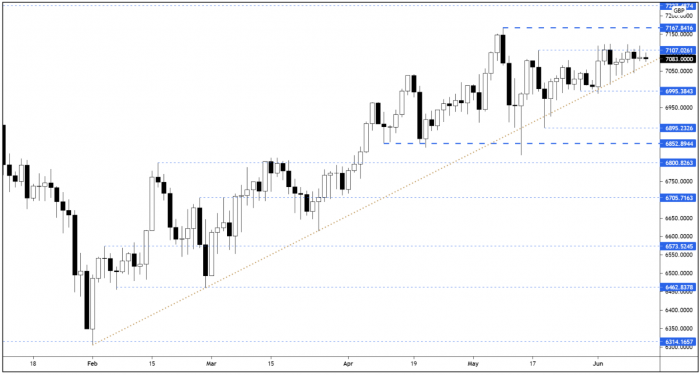

FTSE to open at 7,086 (-2 pts)

Yesterday’s reaction to US inflation data marked a clear shift in sentiment towards the belief that inflation will be transitory…

The US Consumer Price Index hit 5% – it’s highest level since the financial crisis, but stocks rallied and bond yields broke to their lowest levels since March. This bullish reaction indicates that the market no longer as fearful of inflation as it once was.

While in Europe, the ECB kept rates unchanged and avoided any talk of tapering its bond buying program, instead ECB President Christine Lagarde said inflation would remain below target.

The bullish sentiment has fed through into Asian trading and the Hang Seng is up 0.49%, and our Risk Barometer looks ‘risk on’ despite European futures being relatively flat.

| S&P 500 | +0.47% | Bullish for UK stocks |

| Hang Seng | +0.49% | Bullish for UK stocks |

| Gold | +0.19% | Bearish for UK stocks |

| AUD/JPY | +0.26% | Bullish for UK stocks |

| US 10yr Yield | -3.71% | Bullish for UK stocks |

The FTSE failed to break resistance yesterday, despite the S&P flirting with all-time highs and the ECB remaining accommodative.

FTSE futures prices are on course to post their tightest weekly range in over 11 weeks – indicative the current levels of compression in the market.

| Final Results |

| Mind Gym Plc (MIND) |

| Stenprop Limit. (STP) |

| Trading Announcements |

| Frontier Dev (FDEV) |

| UK Economic Announcements |

| (07:00) Balance of Trade |

| (07:00) Gross Domestic Product |

| (07:00) Industrial Production |

| (07:00) Manufacturing Production |

| (07:00) Index of Services |

| International Economic Announcements |

| (07:00) Wholesale Price Index (GER) |

| (15:00) U. of Michigan Confidence (Prelim) (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.