10th Sep 2021. 7.26am

Regency View:

Morning Report – Friday 10th September

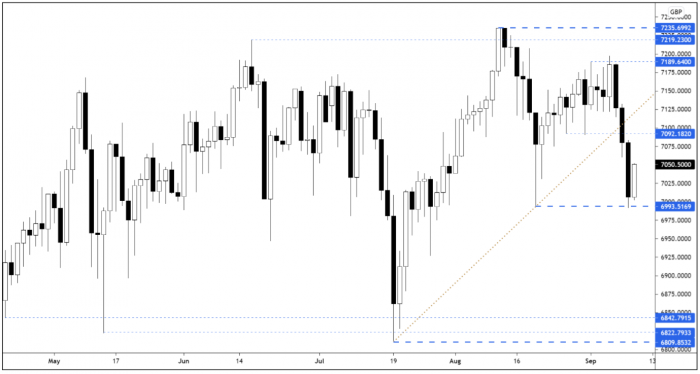

FTSE to open at 7,049 (+25 pts)

Stocks in the US and Europe continued their taper tantrum yesterday as the ECB attempted to reassure investors that it would only slowly withdraw its monetary stimulus…

The ECB said in its policy statement “favourable financing conditions can be maintained with a moderately lower pace of net asset purchases”. And in the a press conference the followed, ECB President Christine Lagarde quipped that “the lady isn’t tapering”.

Overnight in Asia, stocks have bounced back with the Hang Seng and Nikkei up more than 1% on the day.

| S&P 500 | -0.46% | Bearish for UK stocks |

| Hang Seng | +1.59% | Bullish for UK stocks |

| Gold | +0.36% | Bearish for UK stocks |

| AUD/JPY | +0.38% | Bullish for UK stocks |

| US 10yr Yield | -2.63% | Bearish for UK stocks |

Yesterday’s price action saw the FTSE tap the mid-August swing lows that we highlighted in yesterday’s Morning Report.

The futures have bounced from this support level, but whether the rally can be maintained when the cash market opens remains to be seen.

| Final Results |

| Ashmore (ASHM) |

| Interim Results |

| Cip Merchant (CIP) |

| UK Economic Announcements |

| (07:00) Industrial Production |

| (07:00) Manufacturing Production |

| (07:00) Index of Services |

| (07:00) Gross Domestic Product |

| (07:00) Balance of Trade |

| International Economic Announcements |

| (07:00) Consumer Price Index (GER) |

| (13:30) Producer Price Index (US) |

| (15:00) Wholesales Inventories (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.