24th Sep 2021. 7.28am

Regency View:

Morning Report – Friday 24th September

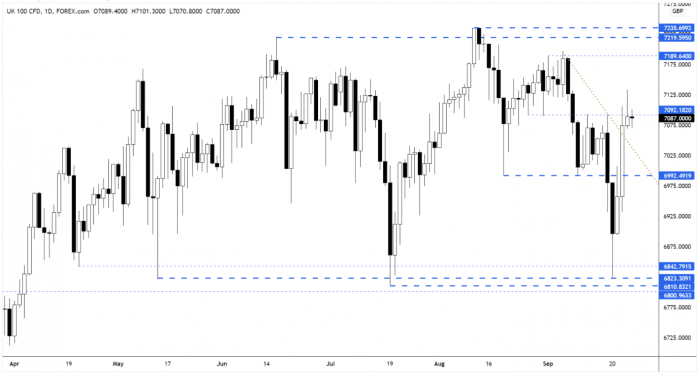

FTSE to open at 7,083 (+5 pts)

The Bank of England signaled yesterday that inflation is set to peak at over 4% this winter, but stressed that no immediate action was needed…

Whilst higher energy prices and supply shortages are driving inflation higher, the central bank maintained its stance that inflation would be “transitory” and would start to ease in Q2 2022.

Price action overnight in Asia has seen Chinese stocks tread water while Japanese stocks have rallied more than 2%.

| S&P 500 | +1.21% | Bullish for UK stocks |

| Hang Seng | -0.10% | Neutral for UK stocks |

| Gold | +0.75% | Bearish for UK stocks |

| AUD/JPY | +0.27% | Bullish for UK stocks |

| US 10yr Yield | +9.65% | Bullish for UK stocks |

The FTSE’s V-shaped recovery ran out of steam yesterday and the market closed well below intra-day highs forming a pin-bar pattern at short-term resistance.

Should we see a break below yesterday’s low in early trading, we could well see an increase in selling pressure as we head into the weekend.

| Interim Results |

| Judges Scientfc (JDG) |

| UK Economic Announcements |

| (00:01) GFK Consumer Confidence |

| International Economic Announcements |

| (09:00) IFO Current Assessment (GER) |

| (09:00) IFO Expectations (GER) |

| (09:00) IFO Business Climate (GER) |

| (15:00) New Homes Sales (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.