20th Sep 2021. 7.42am

Regency View:

Morning Report – Monday 20th September

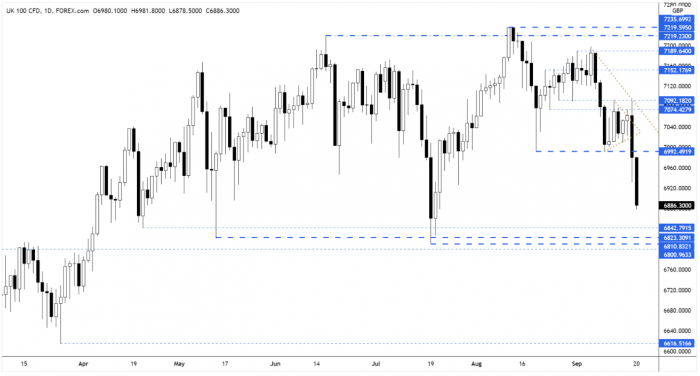

FTSE to open at 6,872 (-91 pts)

The Hang Seng has slumped more than 3% overnight, taking the index to lows not seen since November 2020.

Chinese property stocks were hit the hardest with embattled developer China Evergrande Group plummeting more than 14%.

Looking ahead, central bank policy is the theme this week with the Bank of Japan kicking things off on Tuesday, followed by the US Federal Reserve on Wednesday, and the Bank of England on Thursday.

| S&P 500 | -0.91% | Bearish for UK stocks |

| Hang Seng | -3.43% | Bearish for UK stocks |

| Gold | -0.22% | Bullish for UK stocks |

| AUD/JPY | -0.49% | Bearisj for UK stocks |

| US 10yr Yield | +1.88% | Bullish for UK stocks |

The cyclical nature of volatility was evident in the FTSE’s price action last week…

What started as a building compression ended with a wild and wide-ranging days trading on Friday.

The futures have continued lower in early trading this morning and the market is set to retest the key support zone at 6,800 – 6,842.

| Final Results |

| Finsbury Food (FIF) |

| Wilmington (WIL) |

| Interim Results |

| Frenkel Topping (FEN) |

| Open Orphan (ORPH) |

| International Economic Announcements |

| (07:00) Producer Price Index (GER) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.