28th Jul 2021. 7.47am

Regency View:

Morning Report – Wednesday 28th July

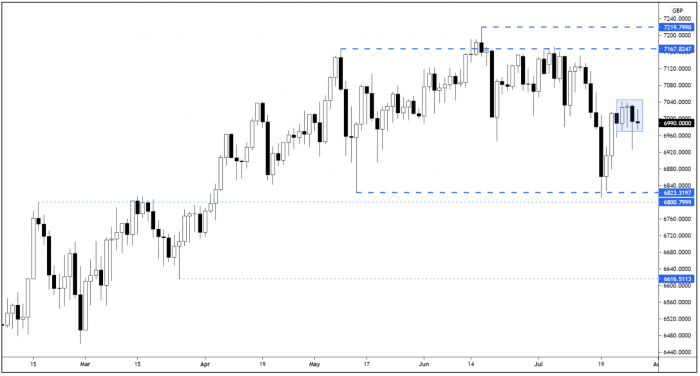

FTSE to open at 6,995 (-1 pt)

The brutal sell-off in Chinese stocks that we’ve seen this week has taken a pause overnight as investors await this evening’s comments from the Fed…

Markets will be watching closely for any hints in relation to inflation, economic growth, the path of interest rates and when the Fed will likely start tapering its bond buying program.

Meanwhile, this morning’s results from Barclays has seen first-half profits nearly treble due to a strong performance from its investment banking business.

| S&P 500 | -0.47% | Bearish for UK stocks |

| Hang Seng | +0.81% | Bullish for UK stocks |

| Gold | +0.35% | Bearish for UK stocks |

| AUD/JPY | +0.17% | Bullish for UK stocks |

| US 10yr Yield | -3.87% | Bearish for UK stocks |

Yesterday’s price action saw the FTSE break lower from the inside day pattern only to close back inside Friday’s range – forming a bullish ‘fakeout’ pattern.

We would expect to see the market retest Friday’s highs during today’s session.

| Final Results |

| Hargreaves Serv (HSP) |

| Shearwater (SWG) |

| Interim Results |

| Aptitude (APTD) |

| Barclays (BARC) |

| British American Tobacco (BATS) |

| Conduit Hldg (CRE) |

| Getbusy (GETB) |

| Hutchmed (HCM) |

| Musicmagpie (MMAG) |

| Primary Health (PHP) |

| Quartix Tech (QTX) |

| Rathbone (RAT) |

| Rio Tinto (RIO) |

| Smurfit Kappa (SKG) |

| St James Place (STJ) |

| Q1 Results |

| Wizz Air (WIZZ) |

| Q2 Results |

| Glaxosmithkline (GSK) |

| Lancashire Holdings (LRE) |

| International Economic Announcements |

| (07:00) GFK Consumer Confidence (GER) |

| (12:00) MBA Mortgage Applications (US) |

| (13:30) Gross Domestic Product (US) |

| (15:30) Crude Oil Inventories (US) |

| (19:00) Fed Interest Rate Decision (US) |

| (19:00) Fed Monetary Policy Statement (US) |

| (19:30) FOMC Press Conference (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.