15th Jul 2021. 7.46am

Regency View:

Morning Report – Thursday 15th July

FTSE to open at 7,074 (-17 pts)

Yesterday’s testimony from Fed Chair Jerome Powell kept to his unwavering stance that the current levels of high inflation would be transitory…

Mr Powell reiterated the central bank’s commitment to maintaining its stimulus until there was more certainty around the strength of the economic recovery. The yield on U.S. 10yr treasuries dropped back on the comments while the reaction on the S&P 500 was relatively muted.

This morning’s UK unemployment data came in slightly higher than exceptions, with the 3-month unemployment rate at 4.8% versus 4.7% expected.

| S&P 500 | -1.13% | Bearish for UK stocks |

| Hang Seng | -1.10% | Bearish for UK stocks |

| Gold | +0.54% | Bearish for UK stocks |

| AUD/JPY | -0.18% | Neutral for UK stocks |

| US 10yr Yield | +73pts | Bearish for UK stocks |

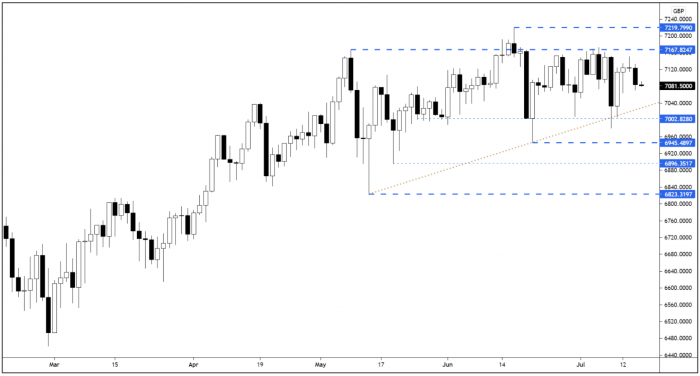

Yesterday’s price action saw the FTSE move lower from Tuesday’s small-range candle. We would expect to see a retest of the support area created by the ascending trendline (gold dotted line) and the cluster of swing lows just above 7,000.

| Interim Results |

| Thungela Res (TGA) |

| Mti Wireless (MWE) |

| UK Economic Announcements |

| (00:01) RICS Housing Market Survey |

| International Economic Announcements |

| (07:00) Wholesale Price Index (GER) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.