20th May 2021. 7.47am

Regency View:

Morning Report – Thursday 20th May

FTSE to open at 6,998 (48 pts)

Wall Street fought back from early weakness yesterday, as minutes of the Federal Open Market Committee’s (FOMC) meeting in late April were released…

Markets had become fearful that the minutes would reveal a more hawkish stance to tapering the Fed’s bond-buying program, but this wasn’t the case. The minutes confirmed the FOMC’s dovish stance and willingness to keep monetary policy as accommodative as possible while the US economy recovers.

| S&P 500 | -0.29% | Neutral for UK stocks |

| Hang Seng | -0.49% | Bearish for UK stocks |

| Gold | +0.26% | Bearish for UK stocks |

| AUD/JPY | +0.28% | Bullish for UK stocks |

| US 10yr Yield | +2.16% | Bearish for UK stocks |

FTSE futures rallied with US markets after the European close to set-up a bullish start to this morning’s session.

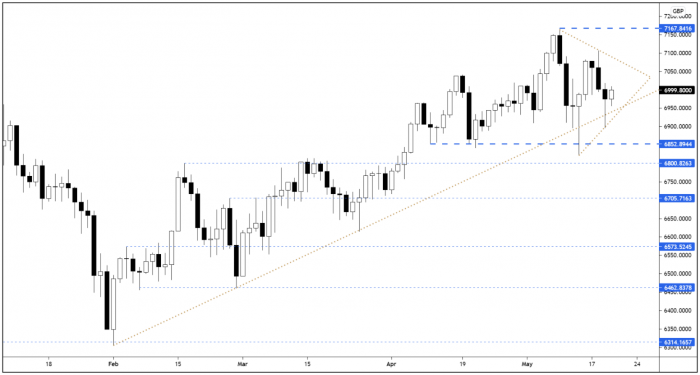

Prices formed another, albeit smaller hammer candle yesterday, and looking at recent price action we can see that a ‘wedge’ consolidation pattern is taking shape.

We’ll be watching closely to see how this wedge develops throughout the remainder of the week.

| Final Results |

| National Grid (NG.) |

| Qinetiq (QQ.) |

| Interim Results |

| easyJet (EZJ) |

| Euromoney (ERM) |

| Nexus Infrastr. (NEXS) |

| Q1 Results |

| Helios Towers (HTWS) |

| Trading Announcements |

| Kistos Plc (KIST) |

| Watches Switz (WOSG) |

| International Economic Announcements |

| (07:00) Producer Price Index (GER) |

| (09:00) Current Account (EU) |

| (13:30) Initial Jobless Claims (US) |

| (13:30) Continuing Claims (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.