13th May 2021. 7.48am

Regency View:

Morning Report – Thursday 12th May

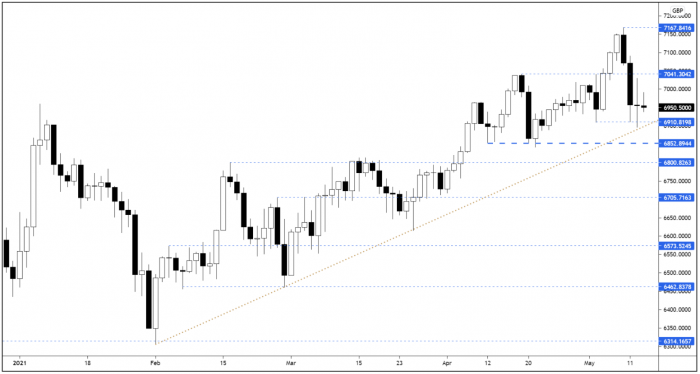

FTSE to open at 6,949 (-55 pts)

We mentioned at the start of the the week that investors were nervous ahead of Wednesday’s US inflation data, and it turns out they had good reason to be…

The US Consumer Price Index jumped to a 13-year high – ramping up pressure on the Fed to tighten monetary policy. The data saw US 10yr Yield put in its biggest one day rally for several months.

Our risk barometer has a distinctly bearish feel to it, and Europrean stocks are set for a bearish open.

| S&P 500 | -2.14% | Bearish for UK stocks |

| Hang Seng | -1.27% | Bearish for UK stocks |

| Gold | +0.28% | Neutral for UK stocks |

| AUD/JPY | +0.08% | Neutral for UK stocks |

| US 10yr Yield | +5.3% | Bearish for UK stocks |

During yesterday’s session, the FTSE futures only started to succumb to US selling pressure after the FTSE cash market’s 4.30pm close.

This leaves the market set to open back near last week’s swing lows. As mentioned yesterday, given the strength of the sell-off at the start of the week, a bounce-back to new trend highs looks unlikely in the short-term.

| Final Results |

| Investec (INVP) |

| Mears (MER) |

| Vertu Motors (VTU) |

| Interim Results |

| Compass Group (CPG) |

| Sage Group (SGE) |

| Q1 Results |

| Ote Ads (OTES) |

| Trading Announcements |

| Coca-Cola HBC (CCH) |

| UK Economic Announcements |

| (07:00) GDP (Preliminary) |

| (07:00) Industrial Production |

| (07:00) Index of Services |

| (07:00) Manufacturing Production |

| (07:00) Balance of Trade |

| (07:00) Gross Domestic Product |

| International Economic Announcements |

| (07:00) Consumer Price Index (GER) |

| (10:00) Industrial Production (EU) |

| (12:00) MBA Mortgage Applications (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.