22nd Apr 2021. 7.46am

Regency View:

Morning Report – Thursday 22nd April

FTSE to open at 6,933 (+38 pts)

The S&P bounced back after two straight day’s of declines…

Interestingly, yesterday’s rally totally erased Tuesday’s losses and this is a very bullish sign. Asian stocks have followed suit, but they remain well below Monday’s highs.

The market will be focused on today’s ECB rate decision and policy statement. There are rumours that more hawkish members of the ECB governing council are trying to push for scaling back its huge bond-buying programme, despite rising Covid-19 infections and continued lockdowns in many European countries.

Should the ECB strike a more hawkish tone, the market will almost certainly respond negatively.

| S&P 500 | +0.93% | Bullish for UK stocks |

| Hang Seng | +0.45% | Bullish for UK stocks |

| Gold | -0.15% | Neutral for UK stocks |

| AUD/JPY | -0.07% | Neutral for UK stocks |

| US 10yr Yield | -0.91% | Neutral for UK stocks |

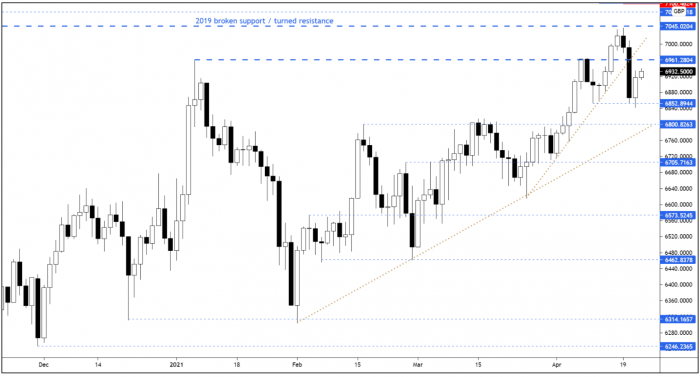

The FTSE bounced from the short-term swing support level at 6,852 yesterday. It now looks as though we will retest resistance at 6,961…

Given the strength of Tuesday’s sell-off relative to yesterday’s bounce, we’d expect selling pressure to kick back in at resistance.

| Final Results |

| Avacta (AVCT) |

| Deltex Medical (DEMG) |

| Jadestone Energy (JSE) |

| Q1 Results |

| Novolip Regs (NLMK) |

| Trading Announcements |

| Aj Bell (AJB) |

| Anglo American (AAL) |

| Gem Diamonds Di (GEMD) |

| Rentokil Initial (RTO) |

| Segro (SGRO) |

| Taylor Wimpey (TW.) |

| International Economic Announcements |

| (09:00) IFO Current Assessment (GER) |

| (09:00) IFO Business Climate (GER) |

| (09:00) IFO Expectations (GER) |

| (10:00) Existing Home Sales (US) |

| (12:45) ECB Interest Rate (EU) |

| (13:30) Initial Jobless Claims (US) |

| (13:30) Continuing Claims (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.