16th Apr 2021. 7.05am

Regency View:

Morning Report – Friday 16th April

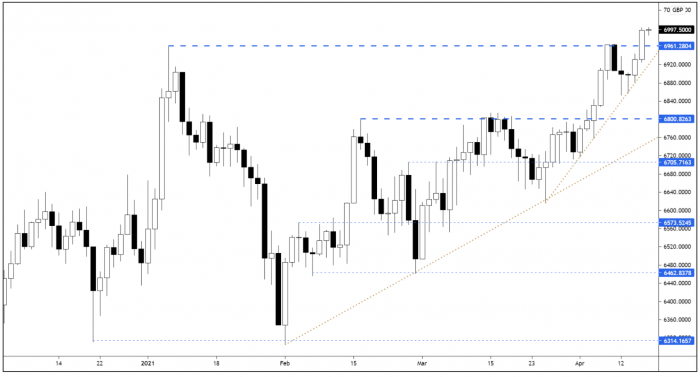

FTSE to open at 6,999 (+16 pts)

The S&P surged back to make new highs yesterday following a raft of strong economic data and reassurances that the Fed will continue to support financial markets.

US retail sales for March jumped by their highest amount in over 10 months, while initial jobless claims fell by 193,000 last week to 576,000, beating market expectations for 700,000 new claims.

The bullish sentiment has continued in Asian trading with Hong Kong’s Hang Seng index up 0.71%.

| S&P 500 | +1.11% | Bullish for UK stocks |

| Hang Seng | +0.71% | Bullish for UK stocks |

| Gold | +0.10% | Neutral for UK stocks |

| AUD/JPY | +0.01% | Neutral for UK stocks |

| US 10yr Yield | +0.11% | Neutral for UK stocks |

The FTSE broke and closed decisively above key resistance, hitting new highs for the year.

Whilst we should never rule out a false breakout scenario whereby the market closes back below support today, yesterday’s price action was undoubtedly bullish and we are expecting the broken resistance level to provide support moving forward.

The market is set to open just below the psychologically significant 7,000 marker and it will be interesting to see if this price point creates some resistance heading into the weekend.

| Q1 Results |

| Pjsc Sev. Regs (SVST) |

| Trading Announcements |

| Ashmore (ASHM) |

| Essentra (ESNT) |

| International Economic Announcements |

| (10:00) Balance of Trade (EU) |

| (10:00) Consumer Price Index (EU) |

| (13:30) Housing Starts (US) |

| (13:30) Building Permits (US) |

| (15:00) U. of Michigan Confidence (Prelim) (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.