7th Apr 2021. 7.46am

Regency View:

Morning Report – Wednesday 7th April

FTSE to open at 6,852 (+28 pts)

US stocks took a well-earned pause for breath yesterday following a burst to new highs earlier in the week. While US bond yields have continued to retreat from highs – cooling the markets inflationary concerns.

Asian stocks have had a mixed session with Hong Kong’s Hang Seng erasing some of Monday’s gains and the Japanese Nikkei in small positive territory.

| S&P 500 | -0.10% | Neutral for UK stocks |

| Hang Seng | -0.72% | Bearish for UK stocks |

| Gold | -0.03% | Neutral for UK stocks |

| AUD/JPY | -0.14% | Neutral for UK stocks |

| US 10yr Yield | -0.11% | Neutral for UK stocks |

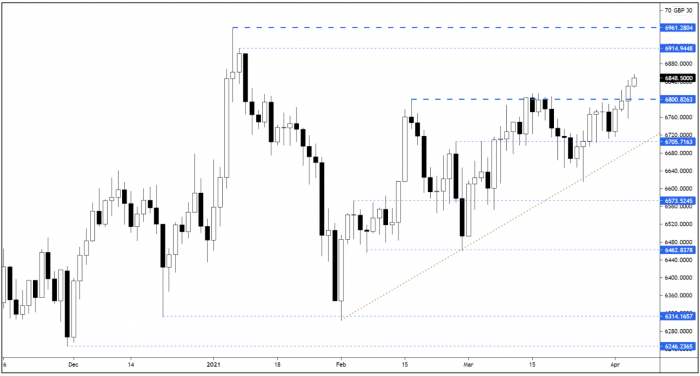

The FTSE broke and closed above the key resistance level at 6,800 that we’ve highlighted for several months. This is clearly a bullish sign and has potentially opened the door for a retest of the New Year highs at 6,961.

We still need to be on guard for a false breakout scenario, whereby the market closes back below resistance during today’s session – creating a ‘two-bar fakeout’ pattern. However, probabilities favour the long side, and if we see strength during today’s opening rotation then this could lead to an acceleration in buying pressure.

| Final Results |

| Hilton Foods (HFG) |

| Igas Energy (IGAS) |

| Pharos Energy (PHAR) |

| UK Economic Announcements |

| (01:01) RICS Housing Market Survey |

| (09:30) PMI Services |

| International Economic Announcements |

| (11:00) MBA Mortgage Applications (US) |

| (15:30) Crude Oil Inventories (US) |

| (20:00) Consumer Credit (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.