24th Mar 2021. 7.49am

Regency View:

Morning Report – Wednesday 23rd March

FTSE to open at 6,667 (-32 pts)

Asian stocks hit two-month lows overnight as the US dollar strengthen to four-month highs following European COVID-19 lockdowns and the posiibility of U.S. tax hikes – denting risk appetite.

The Hang Seng has broken below a key level of support today and this marks a medium-term top of Asian equities – setting us up for a weak start to European trading.

| S&P 500 | -0.76% | Bearish for UK stocks |

| Hang Seng | +2.04% | Bearish for UK stocks |

| Gold | +0.03% | Neutral for UK stocks |

| AUD/JPY | -0.37% | Bearish for UK stocks |

| US 10yr Yield | -1.07% | Bullish for UK stocks |

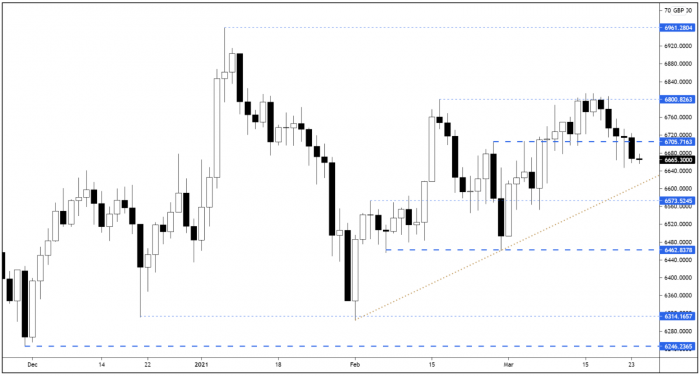

The FTSE failed to muster another fightback and closed below the 6,705 support level that we’ve highlighted over the last week.

A move down towards the ascending trendline just above 6,600 now looks the most likely scenario.

| Final Results |

| Anglo Pacific (APF) |

| Burford Capital (BUR) |

| Circassia (CIR) |

| Cppgroup (CPP) |

| Ecsc Group (ECSC) |

| Kenmare Resources (KMR) |

| Keywords Studio (KWS) |

| Mhp Reg S (MHPC) |

| Pendragon (PDG) |

| Sopheon (SPE) |

| Strix Group (KETL) |

| Tclarke (CTO) |

| Telit (TCM) |

| Interim Results |

| Applied Graph. (AGM) |

| Bellway (BWY) |

| Softcat (SCT) |

| Q4 Results |

| Mhp Reg S (MHPC) |

| Trading Announcements |

| Diploma (DPLM) |

| UK Economic announcements |

| (07:00) Consumer Price Index |

| (07:00) Retail Price Index |

| (07:00) Producer Price Index |

| International Economic Announcements |

| (11:00) MBA Mortgage Applications (US) |

| (12:30) Durable Goods Orders (US) |

| (14:30) Crude Oil Inventories (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.