11th Oct 2022. 7.46am

Regency View:

Morning Report – Tuesday 11th October

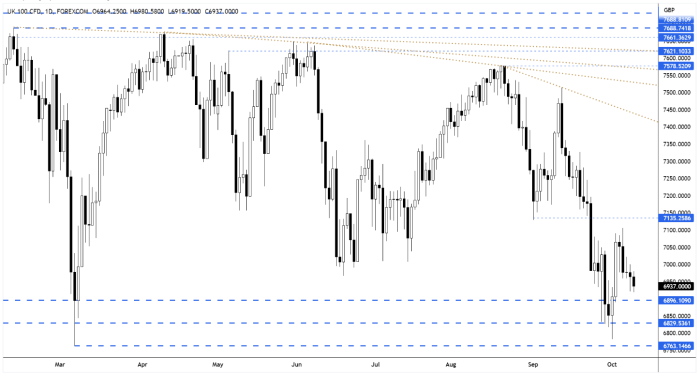

FTSE to open at 6,942 (+17 pts)

Stocks on Wall Street moved lower yesterday as the yield on US 10yr Treasuries edged back towards recent highs.

Asian markets have mirrored the weakness on Wall Street with Hong Kong’s benchmark index dropping to its lowest level in nearly 11 years as investors fretted over new US restrictions on Chinese access to high-end technology.

The Bank of England has widened its bond-buying programme to include index-linked gilts with the central back seeking to quell “dysfunction” in the bond market.

PLEASE NOTE: This Friday will be our last Morning Report bulletin. Moving forward, we will be focusing on our trader education service, Regency Academy. You can sign up to our FREE course, Seven Secrets of Price Action Trading by CLICKING HERE.

| S&P 500 | -0.75% | Bearish for UK stocks |

| Hang Seng | -1.69% | Bearish for UK stocks |

| Gold | +0.02% | Neutral for UK stocks |

| AUD/JPY | -0.50% | Bearish for UK stocks |

| US 10yr Yield | +72pts | Bearish for UK stocks |

The FTSE edged lower yesterday in what looks to be a low volatility retracement.

This morning’s pre-open price action has seen the market retest yesterday’s low – an area which may provide some short-term support.

| Final Results |

| YouGov (YOU) |

| Scs Group (SCS) |

| Interim Results |

| Sndrsn Dsn (SDG) |

| Eneraqua Tech (ETP) |

| Smartspace (SMRT) |

| Trading Announcements |

| Reach Plc (RCH) |

| UK Economic Announcements |

| (00:01) Retail Sales |

| (07:00) Claimant Count Rate |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.