10th Oct 2022. 7.42am

Regency View:

Morning Report – Monday 10th October

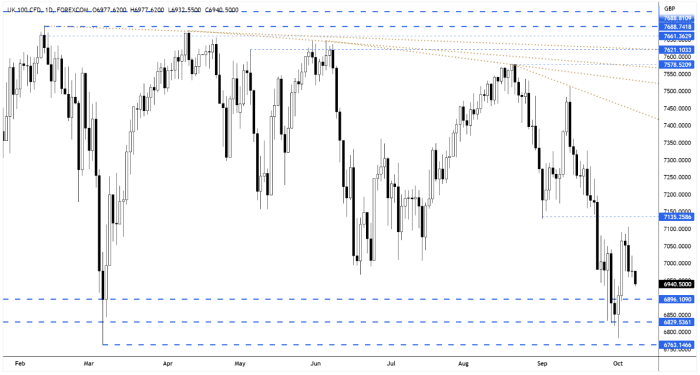

FTSE to open at 6,931 (-60 pts)

Friday’s non-farm payrolls came in ahead of expectations rising by 263,000 in September versus 250,000 expected.

Finally, wage inflation, as measured by the Average Hourly Earnings, fell to 5% on a yearly basis from 5.2%.

Overnight in Asia, stocks have weakened with the Hang Seng down more than -3% and the Nikkei 225 down -0.77% on the day.

US market’s are closed for Columbus Day today and this is likely to see reduced volatility across all asset classes.

Looking ahead this week, we have inflation data from the US and China. The Fed will also release the minutes from its September meeting, which will be watched for indications about the path of interest rate rises.

PLEASE NOTE: This Friday will be our last Morning Report bulletin. Moving forward, we will be focusing on our trader education service, Regency Academy. You can sign up to our FREE course, Seven Secrets of Price Action Trading by CLICKING HERE.

| S&P 500 | -2.80% | Bearish for UK stocks |

| Hang Seng | -3.06% | Bearish for UK stocks |

| Gold | -0.58% | Bullish for UK stocks |

| AUD/JPY | -0.73% | Bearish for UK stocks |

| US 10yr Yield | +60pts | Bearish for UK stocks |

After bursting higher from support last week, the FTSE has drifted lower and the recovery has lost some momentum.

The bulls will be hoping that this drift lower is just a retracement before a second leg higher.

| Trading Announcements |

| Sirius R E. (SRE) |

| Unite (UTG) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.