26th Sep 2022. 7.40am

Regency View:

Morning Report – Monday 26th September

FTSE to open at 7,049 (+30 pts)

After last week’s sell-off, stocks on both sides of the Atlantic are back at their summer lows.

Asia markets have started the week in bearish fashion with the Hang Seng trading -1% lower and the Nikkei 225 down more than -2.5% on the day.

Looking ahead this week, we have gross domestic product figures from the US, Canada and the UK as well as several consumer confidence surveys.

We will also have key inflation data (CPI) from Germany, France and Italy.

| S&P 500 | -1.72% | Bearish for UK stocks |

| Hang Seng | -1.02% | Bearish for UK stocks |

| Gold | -0.33% | Bullish for UK stocks |

| AUD/JPY | -0.13% | Neutral for UK stocks |

| US 10yr Yield | -27pts | Neutral for UK stocks |

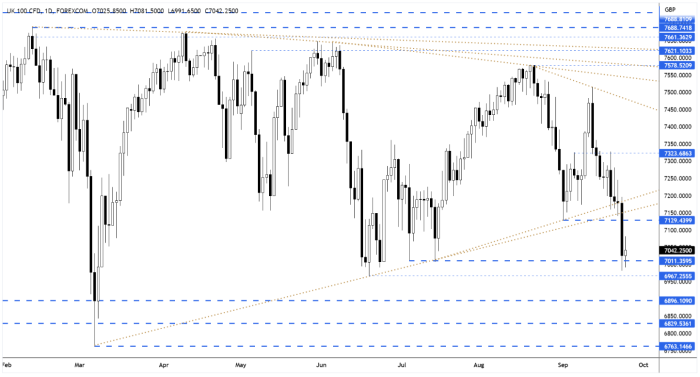

Friday’s price action saw the FTSE break decisively below the long-term wedge pattern which had formed throughout the year.

The break below the wedge coincided with a break of the September swing lows at 7,129. This prompted a sharp drop down to the cluster of swing lows which formed during the summer just above the 7,000 – an area that should provide support.

| Final Results |

| Finsbury Food (FIF) |

| Interim Results |

| Likewise Grp (LIKE) |

| Cppgroup (CPP) |

| Devolver Dig. S (DEVO) |

| Immotion Group. (IMMO) |

| Lunglife Ai (LLAI) |

| Concurrent Technologies (CNC) |

| Microlise Grp (SAAS) |

| Next Fifteen (NFC) |

| Xpediator Plc (XPD) |

| SpaceandPeople (SAL) |

| International Economic Announcements |

| (09:00) IFO Current Assessment (GER) |

| (09:00) IFO Expectations (GER) |

| (09:00) IFO Business Climate (GER) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.