7th Sep 2022. 7.42am

Regency View:

Morning Report – Wednesday 7th September

FTSE to open at 7,252 (-48 pts)

Stocks on Wall Street moved lower yesterday with US Treasury yields surging higher as upbeat data sharpened Fed rate rise fears…

The Institute for Supply Management survey showed that US services activity had outpaced economists’ expectations – registering a reading of 56.9 in August compared with 55.1 expected.

Asian stocks and oil prices have followed Wall Street lower and US dollar strength weighed on sentiment.

| S&P 500 | -0.41% | Bearish for UK stocks |

| Hang Seng | -1.68% | Bearish for UK stocks |

| Gold | -0.28% | Bullish for UK stocks |

| AUD/JPY | +0.57% | Bullish for UK stocks |

| US 10yr Yield | +120pts | Bearish for UK stocks |

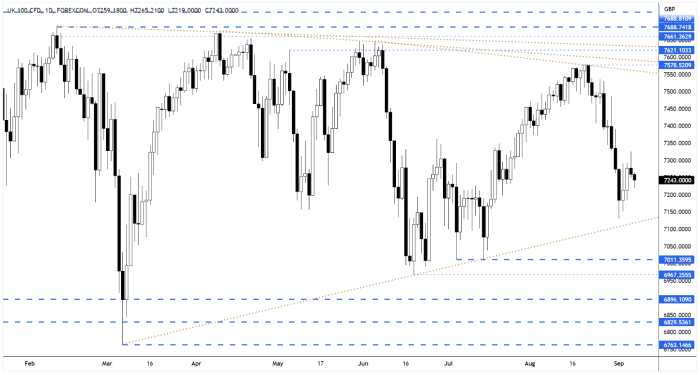

Yesterday’s price action saw the FTSE give up its early morning gains and drift lower – forming a small bearish pin-bar candle.

We now have a short-term inflection point in place (yesterday’s high) at 7,325 which should create some resistance and we have support at last week’s lows (7,129).

| Interim Results |

| Equals Gp (EQLS) |

| Tissue Regenix Group (TRX) |

| M&C Saatchi (SAA) |

| Verici Dx (VRCI) |

| UK Economic Announcements |

| (07:00) Halifax House Price Index |

| International Economic Announcements |

| (07:00) Industrial Production (GER) |

| (12:00) MBA Mortgage Applications (US) |

| (10:00) Gross Domestic Product (EU) |

| (13:30) Balance of Trade (US) |

| (15:30) Crude Oil Inventories (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.