16th Aug 2022. 7.48am

Regency View:

Morning Report – Tuesday 16th August

FTSE to open at 7,527 (+18 pts)

Stocks on Wall Street continued their recent rally yesterday as traders start to price-in a slower pace of tightening from the Federal Reserve.

While Brent crude, the international benchmark for oil dropped as low as $92.78 a barrel yesterday amid fears of a global recession.

Overnight in Asia, the Hang Seng has weakened more than -1.70% despite shares in large Chinese property developers rallying amid reports that regulators could take further steps to support the crisis-stricken sector.

In Europe, this morning’s UK unemployment data edged up to 3.8% as the labour market shows signs of cooling.

| S&P 500 | +0.40% | Bullish for UK stocks |

| Hang Seng | -1.78% | Bearish for UK stocks |

| Gold | +0.06% | Neutral for UK stocks |

| AUD/JPY | +0.01% | Neutral for UK stocks |

| US 10yr Yield | -55pts | Bullish for UK stocks |

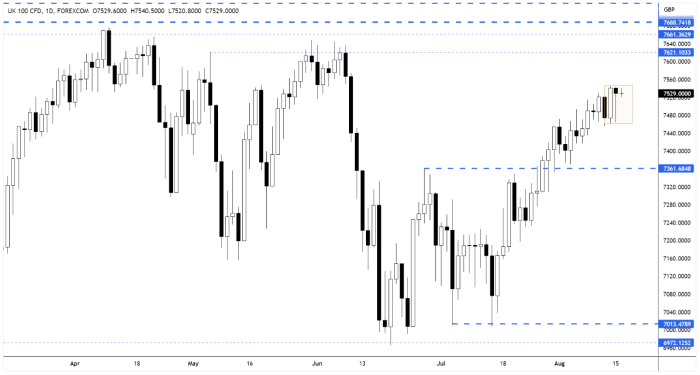

Yesterday’s price action saw the FTSE fight back during afternoon trading – forming a bullish pin-bar candle inside of Friday’s range.

A break above Friday’s highs during the opening rotation could trigger a strong rally.

| Final Results |

| BHP Group (BHP) |

| Interim Results |

| Tribal Grp. (TRB) |

| Tremor Int Ltd (TRMR) |

| Impact Health (IHR) |

| Q2 Results |

| Bank Of Georgia Group (BGEO) |

| Trading Announcements |

| Softline Reg S (SFTL) |

| Watches Switz (WOSG) |

| UK Economic Announcements |

| (07:00) Unemployment Rate |

| (07:00) Claimant Count Rate |

| International Economic Announcements |

| (14:15) Industrial Production (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.