5th Aug 2022. 7.34am

Regency View:

Morning Report – Friday 5th August

FTSE to open at 7,462 (+14 pts)

The Bank of England hiked rates by 0.5 percentage points to 1.75% yesterday…

Whilst the rate hike was in-line with analyst forecasts, the Central Bank’s grim economic forecast surprised the market by indicating that it now expects a longer and deeper recession than it forecast in May.

On Wall Street, stocks had a muted session as US jobless claims hit six-month highs as labour demand cools.

And overnight in Asia, the Hang Seng and Nikkei have made modest gains ahead of this afternoon’s July Non-Farm Payrolls.

| S&P 500 | -0.08% | Neutral for UK stocks |

| Hang Seng | +0.28% | Bullish for UK stocks |

| Gold | -0.07% | Neutral for UK stocks |

| AUD/JPY | +0.29% | Bullish for UK stocks |

| US 10yr Yield | -11pts | Neutral for UK stocks |

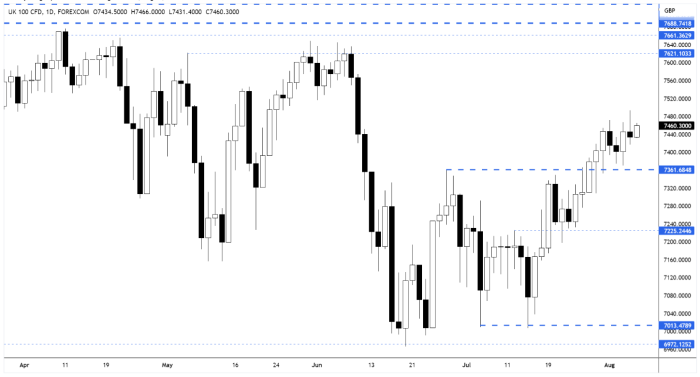

Yesterday’s price action saw the FTSE break above Monday’s swing highs only to retreat and close near intra-day lows – forming a small bearish reversal candle.

A break below yesterday’s low would likely trigger a retest of support at 7,361.

| Final Results |

| Hargreaves Lansdown (HL.) |

| Interim Results |

| F.b.d.hldgs (FBH) |

| WPP (WPP) |

| Synthomer (SYNT) |

| Trading Announcements |

| Pets At Home (PETS) |

| UK Economic Announcements |

| (07:00) Halifax House Price Index |

| International Economic Announcements |

| (07:00) Industrial Production (GER) |

| (13:30) Unemployment Rate (US) |

| (13:30) Non-Farm Payrolls (US) |

| (20:00) Consumer Credit (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.