23rd Jun 2022. 7.45am

Regency View:

Morning Report – Thursday 23rd June

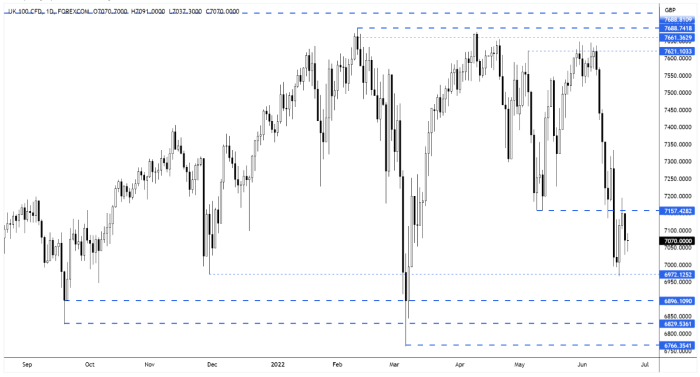

FTSE to open at 7,070 (-19 pts)

Wall Street’s counter-momentum rally faded yesterday, with a slide in oil prices weighing on energy shares that dragged down equity indices.

Fed Chair, Jay Powell warned the US Senate banking committee that further surprises from inflationary trends and a recession was “certainly a possibility”.

Overnight in Asia, Chinese tech shares in Hong Kong staged a strong rebound after Beijing approved a plan for the further development of China’s large payment firms and the fintech sector.

| S&P 500 | -0.13% | Neutral for UK stocks |

| Hang Seng | +1.52% | Bullish for UK stocks |

| Gold | -0.20% | Neutral for UK stocks |

| AUD/JPY | -0.75% | Neutral for UK stocks |

| US 10yr Yield | -121pts | Bullish for UK stocks |

The FTSE’s technical picture hasn’t changed from yesterday’s Morning Report – the market found resistance at broken support and has formed a new inflection point (lower swing high) at Tuesday’s high.

| UK Economic Announcements |

| 08:30 S&P Global/CIPS Services PMI(Jun) PREL |

| International Economic Announcements |

| (07:30) German S&P Global/BME Composite PMI (Jun) PREL (EUR) |

| (08:00) European S&P Global Composite PMI(Jun) PREL (EUR) |

| (13:45) US S&P Global Manufacturing PMI(Jun) PREL (USD) |

| (14:00) Fed’s Chair Powell testifies (USD) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.