10th Jun 2022. 7.45am

Regency View:

Morning Report – Friday 10th June

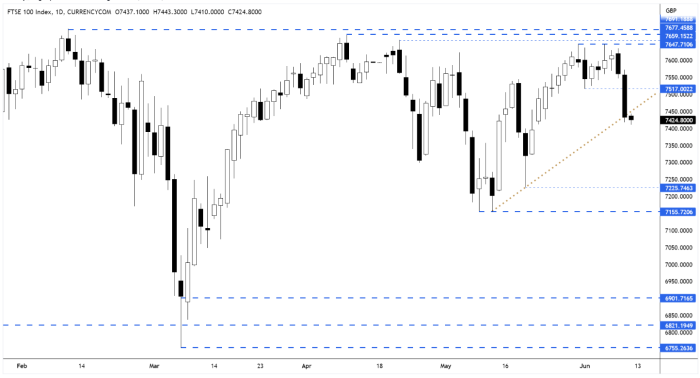

FTSE to open at 7,428 (-48 pts)

The ECB surprised markets yesterday by signalling it was likely to raise rates by half a percentage point in September, in addition to an expected quarter point rise in July.

ECB President Christine Lagarde sought to counter concerns that the central bank is doing too little to fight record-high inflation.

European and US stocks weakened on the ECB’s hawkish tone while the US dollar strengthened.

Overnight in Asia, Hong Kong’s Hang Seng index erased early losses to trade flat on the day, while Japan’s Nikkei 225 mirrored the sell-off on Wall Street.

| S&P 500 | -2.38% | Bearish for UK stocks |

| Hang Seng | -0.02% | Neutral for UK stocks |

| Gold | -0.18% | Neutral for UK stocks |

| AUD/JPY | -0.01% | Neutral for UK stocks |

| US 10yr Yield | +23pts | Bearish for UK stocks |

In yesterday’s Morning Report we indicated that the break below the inside day pattern was likely to setup a press down into 7,500 and that’s exactly what we got.

Prices are now back at the ascending line (gold dotted line) created by the higher swing lows that formed in May.

| International Economic Announcements |

| (12:30) US Consumer Price Index ex Food & Energy (MoM)(May) (USD) |

| (14:00) Michigan Consumer Sentiment Index (Jun) PREL (USD) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.