19th May 2022. 7.43am

Regency View:

Morning Report – Thursday 19th May

FTSE to open at 7,391 (-47 pts)

Wall Street had its worst day since the early months of the coronavirus pandemic, as concerns mounted over global growth…

The S&P 500 tumbled more than -4% yesterday, lead by a -25% plunge in retailer Target after it said higher freight, fuel and wage costs, as well as logistical disruptions would hit profit margins.

Selling pressure has continued throughout the Asian session, with Hong Kong-listed shares in Chinese internet group Tencent falling more than -8.6%, helping to drag the Hang Seng index 2.42% lower.

| S&P 500 | -4.04% | Bearish for UK stocks |

| Hang Seng | -2.42% | Bearish for UK stocks |

| Gold | -0.16% | Neutral for UK stocks |

| AUD/JPY | +0.67% | Bullish for UK stocks |

| US 10yr Yield | -94pts | Bullish for UK stocks |

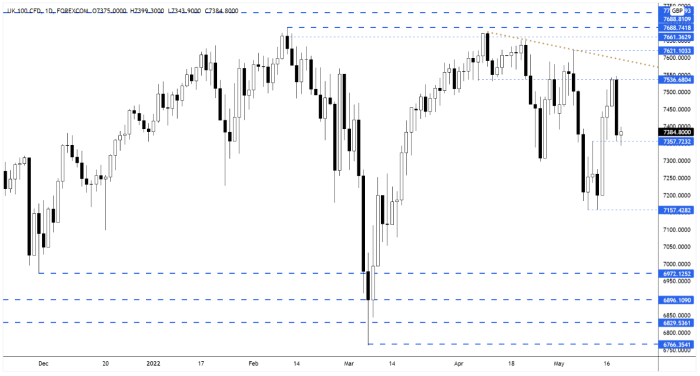

Yesterday’s price action saw the FTSE reverse at the resistance level we’ve highlighted throughout the week.

The sell-off continued after the cash market close at 16:30 with the futures pressing down into short-term support at 7,357 during the later half of the US session.

| Final Results |

| Investec (INVP) |

| National Grid (NG.) |

| Qinetiq (QQ.) |

| Royal Mail (RMG) |

| Q1 Results |

| Ab Ignitis. S (IGN) |

| International Economic Announcements |

| (11:00) ECB Monetary Policy Meeting Accounts (EUR) |

| (12:30) Initial Jobless Claims (May 13) (US) |

| (12:30) Philadelphia Fed Manufacturing Survey (May) (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.