6th Apr 2022. 7.43am

Regency View:

Morning Report – Wednesday 5th April

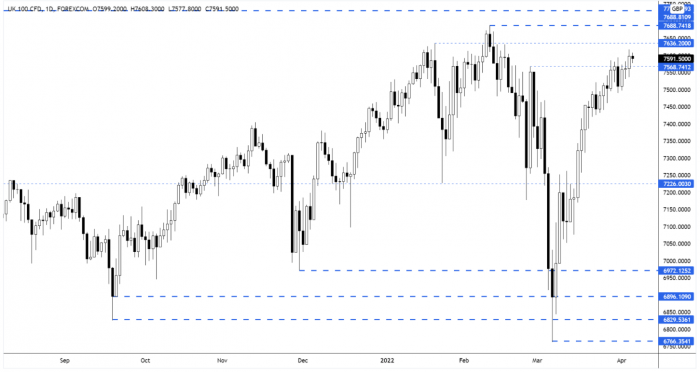

FTSE to open at 7,599 (-15 pts)

US Treasury yields hit multi-year highs and stocks on Wall Street moved lower yesterday following hawkish comments from the Fed…

Fed Governor Lael Brainard said that she expected a combination of interest rate rises and a rapid balance sheet runoff to take US monetary policy to a “more neutral position” later this year.

Asian markets have followed Wall Street lower with China’s Caixin Services PMI data coming in below expectations – showing the fastest contraction in the Chinese services sector for more than two years.

| S&P 500 | -1.26% | Bearish for UK stocks |

| Hang Seng | -1.45% | Bearish for UK stocks |

| Gold | -0.21% | Bullish for UK stocks |

| AUD/JPY | +0.24% | Bullish for UK stocks |

| US 10yr Yield | +151pts | Bearish for UK stocks |

The FTSE pushed higher yesterday – ending a week-long consolidation phase. The market now has the major resistance zone created by the Jan and Feb swing highs in its sights.

| Final Results |

| Hilton Foods (HFG) |

| Epwin Grp (EPWN) |

| Wentworth Res. (WEN) |

| Avacta (AVCT) |

| Gresham House (GRID) |

| Igas Energy (IGAS) |

| International Economic Announcements |

| (07:00) Factory Orders (GER) |

| (08:00) Current Account (GER) |

| (08:00) Balance of Trade (GER) |

| (10:00) Retail Sales (EU) |

| (10:00) Producer Price Index (EU) |

| (12:00) MBA Mortgage Applications (US) |

| (15:50) Crude Oil Inventories (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.