1st Apr 2022. 7.45am

Regency View:

Morning Report – Friday 1st April

FTSE to open at 7,526 (+10 pts)

Stocks on Wall Street slumped yesterday as the S&P 500 index posted its biggest quarterly decline in two years.

While Vladimir Putin threatened to halt contracts supplying Europe with a third of its gas unless they are paid in rubles. And the US announced the biggest release of reserve oil in history with 180 million barrels of oil from the US emergency stockpile hitting the market.

Overnight in Asia, Chinese-focused stocks have eased as Shanghai expands its Covid-19 lockdown.

Looking ahead today, we have US non-farm payrolls data hitting our screens this afternoon, Regency account holders will receive our Non-Farm Payrolls Preview later this morning.

| S&P 500 | -1.57% | Bearish for UK stocks |

| Hang Seng | -0.35% | Bearish for UK stocks |

| Gold | -0.10% | Neutral for UK stocks |

| AUD/JPY | +0.54% | Bullish for UK stocks |

| US 10yr Yield | -9pts | Neutral for UK stocks |

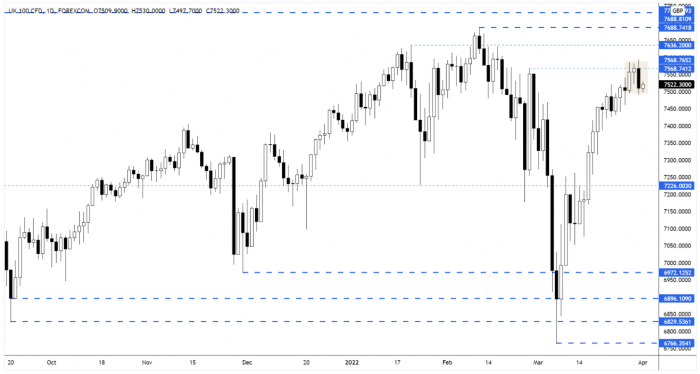

As indicated in yesterday’s Morning Report, the FTSE found resistance at the top of the inside day pattern which formed on Wednesday…

The market rejected resistance and sank straight to the bottom of the inside day range.

| Trading Announcements |

| Pennon (PNN) |

| International Economic Announcements |

| (07:00) Retail Sales (GER) |

| (08:55) PMI Manufacturing (GER) |

| (09:00) PMI Manufacturing (EU) |

| (13:30) Non-Farm Payrolls (US) |

| (13:30) Unemployment Rate (US) |

| (14:45) PMI Manufacturing (US) |

| (15:00) Construction Spending (US) |

| (15:00) ISM Manufacturing (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.