24th Mar 2022. 7.44am

Regency View:

Morning Report – Thursday 24th March

FTSE to open at 7,470 (+9 pts)

Stocks on Wall Street erased almost all of Tuesday’s gains yesterday as the recent recovery started to run out of steam.

Overnight in Asia, stock prices have been volatile as more hawkish comments from Fed officials and the ongoing uncertainty of the Ukraine war left traders uneasy.

Looking ahead, traders attention will be on this afternoon’s US durable goods orders and initial jobless claims.

| S&P 500 | -1.23% | Bearish for UK stocks |

| Hang Seng | -0.75% | Bearish for UK stocks |

| Gold | -0.14% | Neutral for UK stocks |

| AUD/JPY | +0.18% | Neutral for UK stocks |

| US 10yr Yield | -97pts | Bullish for UK stocks |

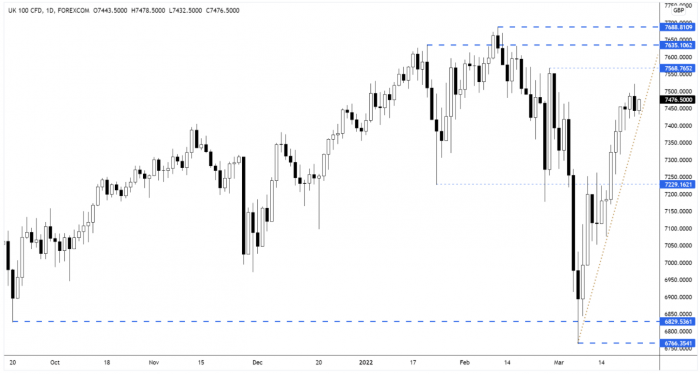

The FTSE failed to maintain its winning run yesterday as the market rejected higher prices and closed lower on the session.

Yesterday’s high at 7,520 is likely to provide some short-term resistance, while the market has the emerging ascending trendline for support.

| Final Results |

| Secure Trust (STB) |

| Robinson (RBN) |

| Eve Sleep (EVE) |

| Bonhill Group (BONH) |

| Bridgepoint (BPT) |

| Sopheon (SPE) |

| Venture Life (VLG) |

| Arbuthnot (ARBB) |

| Wag Payment (WPS) |

| Atalaya Mining (ATYM) |

| Starwood Eur (SWEF) |

| Playtech (PTEC) |

| International Economic Announcements |

| (13:30) Durable Goods Orders (US) |

| (13:30) Current Account (US) |

| (13:30) Continuing Claims (US) |

| (13:30) Initial Jobless Claims (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.