8th Feb 2022. 7.44am

Regency View:

Morning Report – Tuesday 8th February

FTSE to open at 7,594 (+21 pts)

Stocks on Wall Street chopped sideways as traders were caught between the countervailing forces of a resurgent economy and a central bank taking steps to fight inflation.

While in Europe, stocks rallied as ECB President, Christine Lagarde said there were no signs that measurable monetary policy tightening would be required.

Overnight in Asia, stocks have had a mixed session with the Chinese-focused Hang Seng falling -1% and Japan’s Nikkei 225 holding in small positive territory at +0.17%.

| S&P 500 | -0.37% | Bearish for UK stocks |

| Hang Seng | -0.72% | Bearish for UK stocks |

| Gold | -0.17% | Neutral for UK stocks |

| AUD/JPY | +0.25% | Bullish for UK stocks |

| US 10yr Yield | +16pts | Bearish for UK stocks |

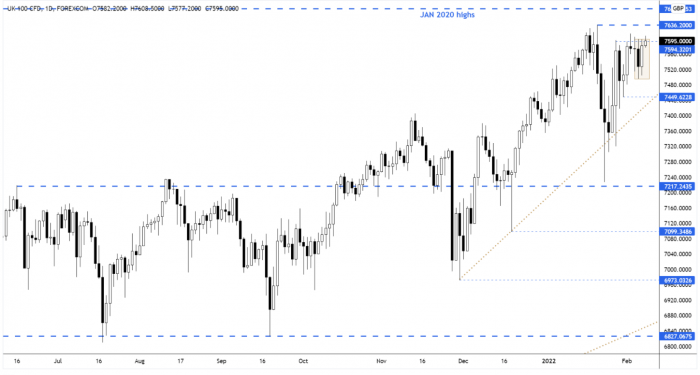

Yesterday’s price action saw the FTSE hold its ground, but remain contained within Friday’s range – forming a bullish ‘inside day’ pattern.

The market is now compressed beneath resistance and this tips the probabilities in favour of a breakout.

| Final Results |

| Ocado (OCDO) |

| Micro Focus (MCRO) |

| BP (BP.) |

| Interim Results |

| Mattioli (MTW) |

| Filtronic (FTC) |

| Alumasc Group (ALU) |

| Q1 Results |

| TUI AG (TUI) |

| Q4 Results |

| BP (BP.) |

| Trading Announcements |

| Bellway (BWY) |

| Interim Management Statement |

| DCC (DCC) |

| International Economic Announcements |

| 13:30 Goods and Services Trade Balance (Dec) |

| 13:30 Goods Trade Balance (Dec) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.