12th Jan 2022. 7.42am

Regency View:

Morning Report – Wednesday 12th January

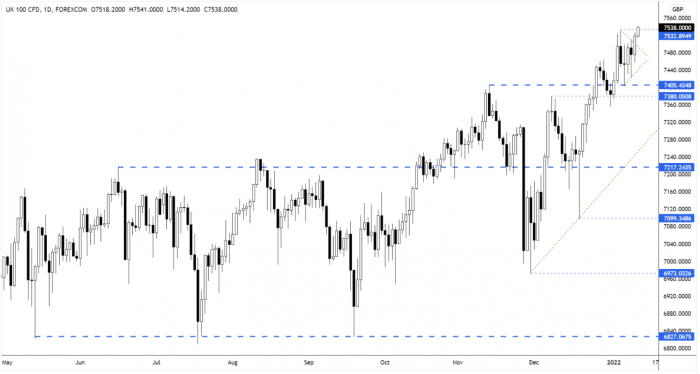

FTSE to open at 7,538 (+47 pts)

Wall Street rallied yesterday as Fed Chair Jay Powell made assurances that the central bank would act to curb inflation before it gets out of control…

Addressing the Senate, Powell said high inflation had taken a “toll” and the Fed would act to prevent it from “becoming entrenched”. The comments come ahead of today’s US Consumer Price Index data for December.

Asian stocks have followed Wall Street higher and it is also worth noting that oil (Brent crude) has touched pre-Omicron highs in early trading.

| S&P 500 | +0.92% | Bullish for UK stocks |

| Hang Seng | +2.52% | Bullish for UK stocks |

| Gold | -0.24% | Bullish for UK stocks |

| AUD/JPY | +0.06% | Neutral for UK stocks |

| US 10yr Yield | -17pts | Bullish for UK stocks |

The FTSE broke out from the small bull flag consolidation pattern that we highlighted in yesterday’s Morning Report.

With the FTSE futures continuing higher in early trading, the cash market is set to open at last week’ swing highs.

| Interim Results |

| Gateley Hldgs (GTLY) |

| Trading Announcements |

| Sainsbury (J) (SBRY) |

| Nichols (NICL) |

| International Economic Announcements |

| 13:30 Consumer Price Index ex Food & Energy (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.