16th Dec 2021. 7.41am

Regency View:

Morning Report – Thursday 16th December

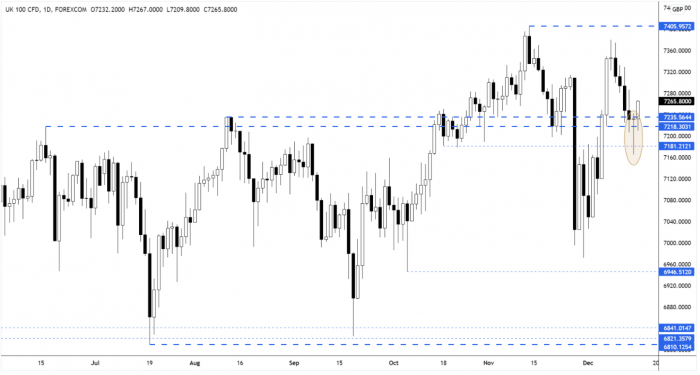

FTSE to open at 7,264 (+93 pts)

The Fed delivered a decisively hawkish statement yesterday – penciling in three rate rises next year and doubling the pace of its tapering.

Counter-intuitively, US stocks rallied on the back of the central bank’s plans, as traders welcomed the clarity of the statement.

Chinese stocks were flat despite the gains on Wall Street due to worries that Washington might blacklist more Chinese companies.

Today, it is Europe’s turn to outline it’s monetary policy plans, with the Bank of England and ECB making rate decisions and policy statements.

| S&P 500 | +1.63% | Bullish for UK stocks |

| Hang Seng | +0.19% | Neutral for UK stocks |

| Gold | +0.49% | Bearish for UK stocks |

| AUD/JPY | +0.21% | Bullish for UK stocks |

| US 10yr Yield | +1.36% | Bearish for UK stocks |

We finally saw a bullish response at the support zone, with the FTSE fighting back to close near intra-day highs – forming a bullish pin-bar candle.

Overnight, the futures have kicked on higher from the pin-bar candle, setting the cash market up for a strong open.

| UK Economic Announcements |

| 09:30 Markit Manufacturing PMI |

| 12:00 Bank of England Minutes |

| 12:00 Bank of England Interest Rate Decision |

| 12:00 Monetary Policy Summary |

| International Economic Announcements |

| 09:00 European Markit Manufacturing PMI |

| 12:45 ECB Interest Rate Decision |

| 12:45 ECB Monetary Policy Statement |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.