14th Dec 2021. 7.45am

Regency View:

Morning Report – Tuesday 14th December

FTSE to open at 7,276 (+45 pts)

Wall Street trader lower yesterday as traders grew nervous ahead of a busy week of central bank meetings…

The US Federal Reserve, the European Central Bank and the Bank of England are all due to make policy announcements this week, and with high levels of inflation, markets are cautious that central bankers may strike a more hawkish tone.

Overnight in Asia, stocks have mirrored the sell-off on Wall Street as the Asian Development Bank trimmed its growth forecast to account for the impact of the Omicron variant.

| S&P 500 | -0.91% | Bearish for UK stocks |

| Hang Seng | -1.44% | Bearish for UK stocks |

| Gold | +0.03% | Neutral for UK stocks |

| AUD/JPY | -0.02% | Neutral for UK stocks |

| US 10yr Yield | -5.15% | Bullish for UK stocks |

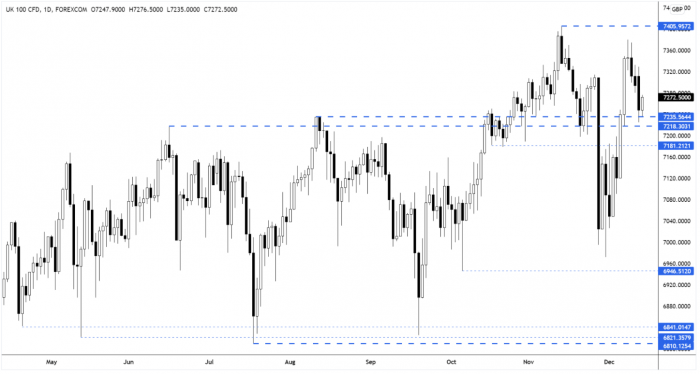

Yesterday’s price action saw the pullback deepen, and price are now back at the support zone created by the summer highs…

It’s worth noting that whilst the market has responded to this support zone on multiple occasions, it was broken decisively during the end November sell-off and this reduces its significance.

| Final Results |

| Driver Grp (DRV) |

| Chemring (CHG) |

| Rws Hldgs (RWS) |

| Interim Results |

| Purplebricks (PURP) |

| Goodwin (GDWN) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.