10th Dec 2021. 7.29am

Regency View:

Morning Report – Friday 10th December

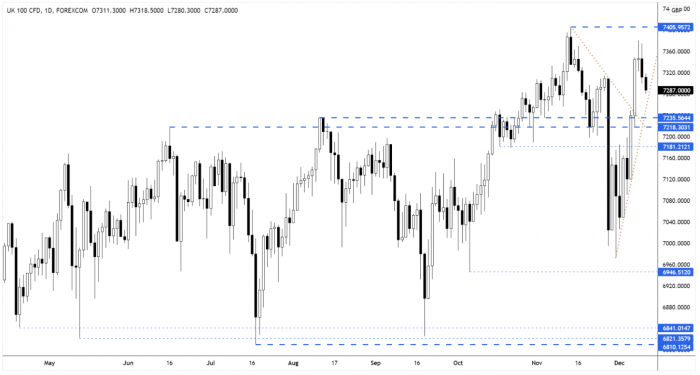

FTSE to open at 7,287 (-34 pts)

Wall Street dipped yesterday with tech stocks showing the highest level of weakness as traders took some risk off the table as the weekend approaches.

Overnight in Asia, Japan’s wholesale inflation hit a record 9.0% in November – a sign that supply bottlenecks and rising raw material costs are continuing to apply upwards pressure on prices.

Today, all eyes will be on this afternoon’s US CPI data, as the Fed looks to combat inflation via monetary tightening despite the uncertainty created by the Omicron variant.

| S&P 500 | -0.72% | Bearish for UK stocks |

| Hang Seng | -0.88% | Bearish for UK stocks |

| Gold | -0.12% | Neutral for UK stocks |

| AUD/JPY | +0.19% | Neutral for UK stocks |

| US 10yr Yield | -1.41% | Bullish for UK stocks |

After last week’s whipsaw price action, this week’s strong directional move higher has given bulls plenty to cheer about.

A pullback from such a steep rally was almost inevitable, but to maintain the bullish momentum into next week, the FTSE will ideally need to end the week above 7,270.

| Final Results |

| Nexus Infrastr. (NEXS) |

| International Economic Announcements |

| (15:00) U. of Michigan Confidence (US) |

| (13:30) Consumer Price Index (US) |

| (07:00) Balance of Trade |

| (07:00) Gross Domestic Product |

| (07:00) Index of Services |

| (07:00) Manufacturing Production |

| (07:00) Industrial Production |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.