7th Dec 2021. 7.45am

Regency View:

Morning Report – Tuesday 7th December

FTSE to open at 7,272 (+40 pts)

Travel stocks lead Wall Street higher yesterday as fears that Omicron would lead to fresh lockdowns eased.

While Chinese stock have been given a boost after Beijing signaled its first substantial policy loosening since the early days of the pandemic…

China’s central bank said it would free up Rmb1.2tn ($188bn) of liquidity for the banking system by cutting its reserve ratio by 50 basis points.

| S&P 500 | +1.17% | Bullish for UK stocks |

| Hang Seng | +2.50% | Bullish for UK stocks |

| Gold | +0.27% | Bearish for UK stocks |

| AUD/JPY | +0.73% | Bullish for UK stocks |

| US 10yr Yield | +3.65% | Bearish for UK stocks |

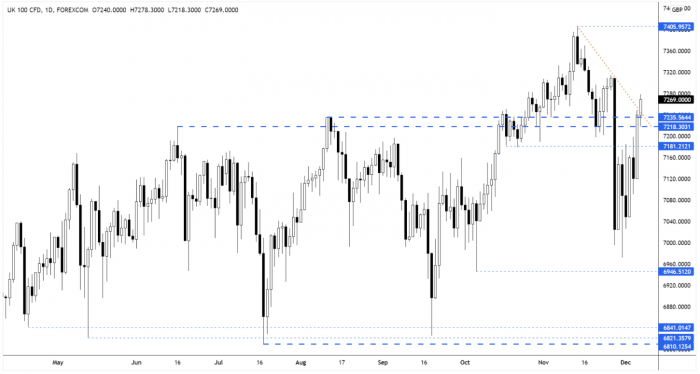

The FTSE broke higher with strong momentum yesterday – taking prices deep into the resistance zone.

This has been followed by further gains from the futures overnight, and the cash market is set to open above both the horizontal resistance zone and descending retracement line created by the recent series of lower swing highs.

| Final Results |

| Hyve Grp. (HYVE) |

| Ixico (IXI) |

| Renew Holdings (RNWH) |

| Paragon Group (PAG) |

| Caretech Hldg (CTH) |

| Interim Results |

| Kinovo Plc (KINO) |

| Mercia Asset (MERC) |

| Vianet Grp (VNET) |

| Supreme Plc (SUP) |

| Babcock (BAB) |

| Solid State (SOLI) |

| SDI Group (SDI) |

| International Economic Announcements |

| (10:00) ZEW Survey (GER) – Economic Sentiment |

| (10:00) ZEW Survey (GER) – Current Situation |

| (20:00) Consumer Credit (US) |

| (10:00) Gross Domestic Product (EU) |

| (10:00) ZEW Survey (EU) – Economic Sentiment |

| (07:00) Industrial Production (GER) |

| (07:00) Halifax House Price Index |

| (00:01) Retail Sales |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.