16th Nov 2021. 7.46am

Regency View:

Morning Report – Tuesday 16th November

FTSE to open at 7,344 (-8 pts)

Wall Street ended an indecisive session little-changed on Monday with traders caught between strong economic data and the prospect of tightening Fed monetary policy.

While overnight in Asia, Chinese stocks have bounced due to a rebound in property stocks and positivity surrounding talks between US President Biden and Xi Jinping, with both leaders stressing their responsibility to the rest of the world to avoid conflict.

This morning’s UK unemployment data came in slightly ahead of expectations at 4.3% for the three months to September.

Traders will be keeping a close eye on this morning’s European GDP data, along with this afternoon’s US retail sales.

| S&P 500 | 0.00% | Neutral for UK stocks |

| Hang Seng | +1.02% | Bullish for UK stocks |

| Gold | +0.01% | Neutral for UK stocks |

| AUD/JPY | +0.03% | Neutral for UK stocks |

| US 10yr Yield | +3.30% | Bearish for UK stocks |

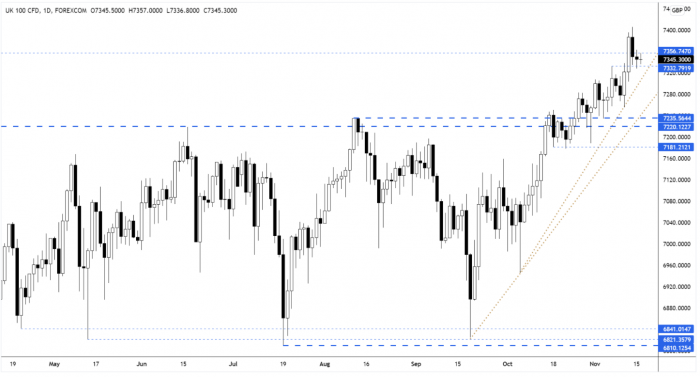

Yesterday’s price action saw the FTSE print its smallest daily range in over four sessions – signalling that we’re starting to see some volatility compression.

Given the strength of the FTSE’s uptrend, probabilities continue to favour an expansive move in the direction of the trend.

| Final Results |

| Focusrite (TUNE) |

| Imperial Brands (IMB) |

| Rev Bars (RBG) |

| Interim Results |

| Adept Tech. (ADT) |

| Gear4music (G4M) |

| Homeserve (HSV) |

| Mckay Securities (MCKS) |

| Premier Foods (PFD) |

| Vodafone (VOD) |

| UK Economic Announcements |

| (07:00) Unemployment Rate |

| (07:00) Claimant Count Rate |

| International Economic Announcements |

| (10:00) GDP (Preliminary) (EU) |

| (13:15) Industrial Production (US) |

| (13:30) Retail Sales (US) |

| (13:30) Import and Export Price Indices (US) |

| (14:15) Capacity Utilisation (US) |

| (15:00) Business Inventories (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.