15th Nov 2021. 7.40am

Regency View:

Morning Report – Monday 15th November

FTSE to open at 7,336 (-12 pts)

This morning’s Chinese industrial production and retail sales data came in ahead of expectations…

Chinese industrial production (YoY) (Oct) increased 3.5% versus 3% expected and Chinese retail sales (YoY) (Oct) jumped 4.9% versus 3.5% expected.

Looking ahead, politicians will be grilling Bank of England (BoE) governor Andrew Bailey and other members of the Monetary Policy Committee (MPC) when they appear before the Treasury committee this morning.

MP’s will want to know why the BoE didn’t raise rates to tackle inflation when it had been previously signaled.

| S&P 500 | +0.72% | Bullish for UK stocks |

| Hang Seng | +0.04% | Neutral for UK stocks |

| Gold | -0.41% | Bullish for UK stocks |

| AUD/JPY | +0.32% | Bullish for UK stocks |

| US 10yr Yield | -1.93% | Bullish for UK stocks |

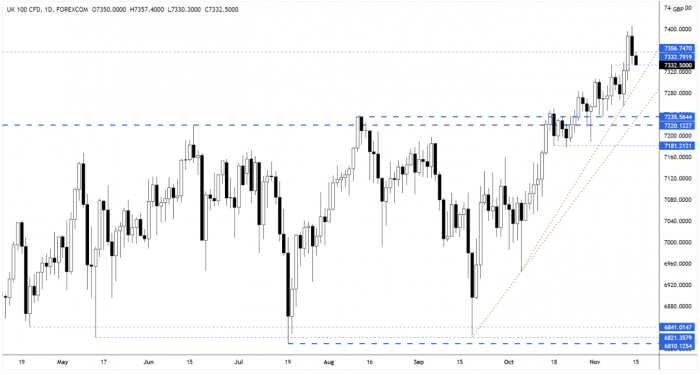

After a relatively strong swing to the upside last week, the FTSE looks to be in ‘retracement mode’ as we head towards the opening bell…

Prices have moved lower during the early hours, continuing Friday’s pullback. We would expect to see some support provided by the broken swing highs at 7,335.

| Final Results |

| Nightcap (NGHT) |

| Interim Results |

| Totally (TLY) |

| Q3 Results |

| Fondul Proprietatea (FP.) |

| HgCapital Trust plc (HGT) |

| Trading Announcements |

| Kingspan (KGP) |

| International Economic Announcements |

| (07:00) Wholesale Price Index (GER) |

| (10:00) Balance of Trade (EU) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.