2nd Nov 2021. 7.40am

Regency View:

Morning Report – Tuesday 2nd November

FTSE to open at 7,281 (-8 pts)

Wall Street’s rally stalled yesterday as traders grew hesitant ahead of Wednesday’s key Fed policy statement.

It is also worth noting that in yesterday’s European session, Italian government debt was sold off, and the gap in bond yields between German (safe haven) and Italian (riskier debt) grew to their highest levels in over a year – signalling concerns over the ECB’s backing of risky debt.

Overnight in Asia, Hong Kong’s Hang Seng index gave up its early gains and is now trading in negative territory, as is Japan’s Nikkei 225.

| S&P 500 | +0.18% | Neutral for UK stocks |

| Hang Seng | -0.31% | Bearish for UK stocks |

| Gold | +0.08% | Neutral for UK stocks |

| AUD/JPY | -0.87% | Bullish for UK stocks |

| US 10yr Yield | -1.24% | Bullish for UK stocks |

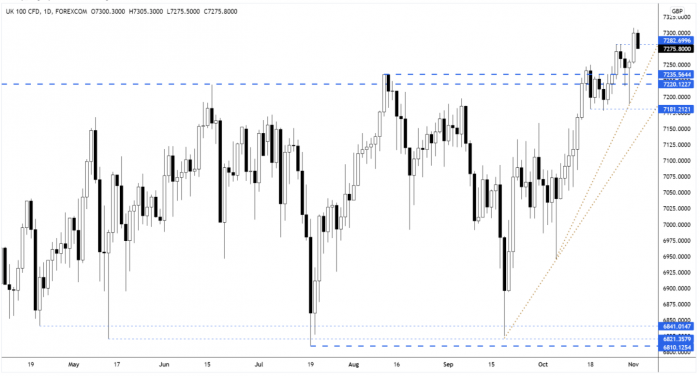

Yesterday’s price action saw the FTSE break higher from the bullish pin-bar we identified yesterday – closing above last week’s highs.

Today’s pre-open price action has seen the market retreat back within yesterday’s range, but as long as the market remains above yesterday’s lows our short-term bias will be bullish.

Watch our FTSE 100 Technical Outlook video to see the next key areas of resistance on the FTSE.

| Final Results |

| Oncimmune (ONC) |

| Up Global (UPGS) |

| Interim Results |

| First Derivatives (FDP) |

| Q3 Results |

| BP (BP.) |

| Standard Chartered (STAN) |

| Trading Announcements |

| Flutter Ent (FLTR) |

| International Economic Announcements |

| (08:55) PMI Manufacturing (GER) |

| (09:00) PMI Manufacturing (EU) |

| (20:30) Auto Sales (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.