26th Oct 2021. 7.45am

Regency View:

Morning Report – Tuesday 26th October

FTSE to open at 7,238 (+15 pts)

The S&P completed it’s month-long fight-back yesterday as the market broke and closed above the September highs – marking a new record for the US benchmark.

While President Joe Biden remains hopeful for an agreement on his major spending plans before he attends a climate summit in Scotland.

In Asia, the Hang Seng gave up early gains as fresh worries about China’s property sector weighed on investors’ sentiments…

Another developer, Modern land, defaulted on a payment – adding to worries about the contagion effects of the debt crisis at China Evergrande Group.

| S&P 500 | +0.47% | Bullish for UK stocks |

| Hang Seng | -0.72% | Bearish for UK stocks |

| Gold | -0.12% | Neutral for UK stocks |

| AUD/JPY | +0.49% | Bullish for UK stocks |

| US 10yr Yield | -1.02% | Bullish for UK stocks |

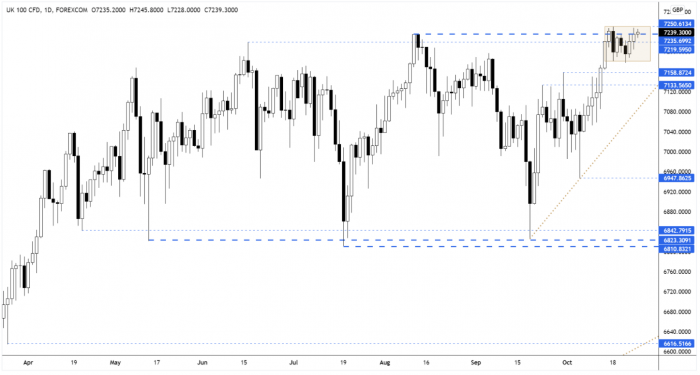

The FTSE failed to follow the S&P in breaking through resistance, and the market remains coiled within the mini-range which formed following last week’s inside day pattern.

Given the length of time the market has been consolidating, we are likely to see some directional follow-through should the market muster a breakout.

| Final Results |

| E-therapeutics (ETX) |

| Q3 Results |

| Reckitt Ben. Gp (RKT) |

| Trading Announcements |

| Rws Hldgs (RWS) |

| International Economic Announcements |

| (14:00) House Price Index (US) |

| (15:00) Consumer Confidence (US) |

| (15:00) New Homes Sales (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.